🟡 The Second Act: Why Gold Is Poised for a Historic Repricing

By Gold-Broker.com – July 25, 2025

“History never repeats itself, but it does often rhyme.”

– Mark Twain

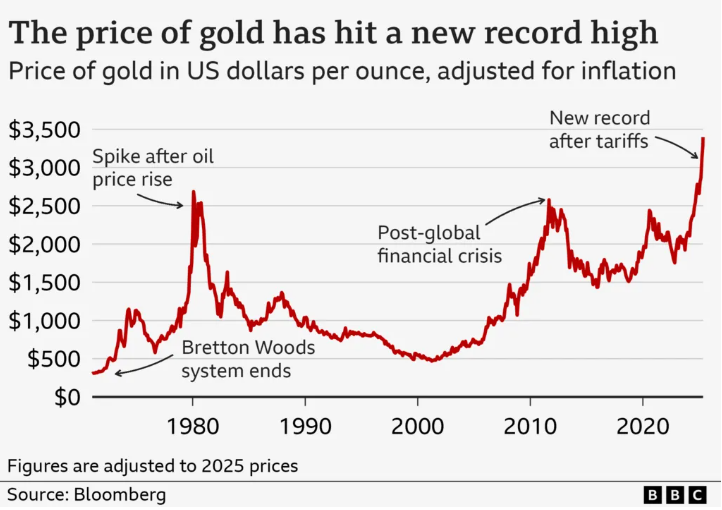

When the United States closed the gold window in 1971, few understood the scale of what had just begun. The decision to end the dollar’s convertibility into gold was sold as temporary. It wasn’t. What followed was a decade marked by inflation, loss of monetary discipline, and eventually, a gold price that skyrocketed over 2,300% in less than 10 years.

Fast forward to today, and the same forces appear to be gathering—only this time, the stakes are much higher. Welcome to the Second Act of the global monetary reset.

The 1970s: The First Act of Gold’s Awakening

To understand the present, we must revisit the past.

In 1971, President Nixon suspended the dollar’s convertibility into gold, ending the Bretton Woods system. This “temporary” move officially ushered in the era of fiat money—currency backed by nothing more than government decree. The consequences were swift and severe:

- The U.S. dollar lost over 60% of its purchasing power in that decade.

- Consumer inflation surged to double digits.

- Investors fled to real assets.

- Gold rose from $35/oz to $850/oz by 1980.

It was a classic case of monetary debasement leading to asset repricing. Gold didn’t just rise—it repriced itself in relation to a currency that was being actively diluted.

The 2020s: Same Song, Different Verse

Now, five decades later, we’re seeing a similar dynamic unfold—but with a modern twist.

Since 2008, central banks have operated under a doctrine of perpetual stimulus. When crises hit, interest rates are cut to zero. Quantitative easing floods the financial system with liquidity. Government debt is monetized, often through complex asset swaps that obscure their true inflationary impact.

Then came COVID-19, which broke the last taboos:

- Central banks directly financed government spending.

- Trillions were printed with no offsetting economic growth.

- Inflation re-emerged—first as “transitory,” then as “entrenched.”

This is not normal. And increasingly, investors know it.

The Gold Market Is Changing Beneath the Surface

What’s different today is the structural shift taking place beneath the headlines. It’s not just about inflation or dollar weakness. It’s about a growing loss of confidence in the entire fiat currency architecture.

Consider the following:

1. Record Central Bank Gold Buying

Central banks bought over 1,000 tonnes of gold in 2023, the highest annual total since records began. Why?

Because nations like China, India, Russia, and Turkey no longer trust the U.S. dollar as a neutral reserve asset. Gold—uncensorable, uninflatable, and politically agnostic—is reasserting itself as a core pillar of sovereign reserves.

2. Paper Gold vs. Physical Gold: A Dangerous Disconnect

The gold price is still heavily influenced by paper markets like COMEX and London, where vast quantities of gold are traded on margin, often without physical delivery.

But that system is cracking:

- Delivery requests are rising.

- Registered physical inventories are falling.

- The ratio of paper claims to physical metal is at historic highs.

When enough people want delivery instead of paper promises, the game changes. Rapidly.

3. Calls for Revaluation of U.S. Gold Reserves

Quietly, some U.S. policymakers have floated a radical but legal idea: revaluing America’s official gold reserves—still booked at $42.22/oz—to market price.

If the Treasury marked its gold to $2,800/oz, it could unlock nearly $500 billion in seigniorage without issuing more debt. In a political climate demanding fiscal responsibility but refusing austerity, such moves are no longer unthinkable.

It would amount to monetizing gold, not debt.

Why the Next Repricing Could Be Bigger—and Faster

The 1970s gold bull market unfolded in a world with:

- Lower debt-to-GDP ratios

- Tighter energy supplies

- Smaller derivatives markets

- Limited investor access

Today’s financial system is far more fragile and globally interconnected. The buildup of risk is immense:

| Metric | 1970s | 2025 |

|---|---|---|

| U.S. Debt-to-GDP | < 40% | > 120% |

| Fed Balance Sheet | < $200B | > $8 trillion |

| Gold as % of Global Assets | ~5% | < 1% |

| Gold Price (adjusted) | $850 (1980) | ~$3,100 (target parity) |

The more debt and leverage built atop a system, the more violently it must adjust when confidence slips. Gold is that adjustment mechanism.

What Investors Are Doing Now

At GoldBroker.com, we are seeing consistent trends across client accounts—both institutional and individual:

- Long-term allocation to physical gold and silver, not just ETFs.

- Vaulted storage in multiple jurisdictions—France, Switzerland, Singapore.

- Increased demand for non-banking access to precious metals, fully owned and allocated.

These are not short-term speculations. They are strategic moves toward sovereignty in a system that’s increasingly prone to capital controls, bail-ins, and political intervention.

What Happens If Trust Breaks Down?

Let’s be clear: gold doesn’t just rise during inflation. It rises when trust breaks—in currencies, institutions, and central bank competence.

This is not fear-mongering. It’s observable in:

- The weaponization of the dollar (e.g., freezing Russia’s reserves).

- The rise of BRICS gold-backed settlement systems.

- A growing global call for neutral, apolitical stores of value.

In such a world, gold doesn’t just outperform—it becomes a parallel monetary system.

What About Silver?

Silver often lags gold during the early stages of repricing—but historically outpaces gold in late-stage bull markets.

In 1980, the gold/silver ratio briefly fell below 20. Today, it’s around 80. If gold hits $3,000/oz and the ratio reverts to 40, silver could reach $75/oz or higher.

Silver’s dual use—monetary and industrial—makes it especially compelling in an era of electrification and green energy demand.

How to Prepare

Here’s what we believe investors should consider:

✅ 1. Own Physical, Not Paper

Paper gold (ETFs, futures) exposes you to counterparty and redemption risk. Physical bullion—fully allocated and in your name—removes that uncertainty.

✅ 2. Store Outside the Banking System

In times of crisis, banks may impose withdrawal limits or freeze accounts. Gold stored in secure, non-bank vaults gives you access, privacy, and legal clarity.

✅ 3. Diversify Jurisdictions

Don’t keep all your metal in one country. Consider international storage in politically neutral, gold-friendly nations.

✅ 4. Think Long-Term

Gold is not a get-rich-quick asset. It’s wealth insurance—a hedge against the failure of fiat systems and a store of value over generations.

Final Thoughts: The Endgame Is Monetary Realignment

The financial world is quietly acknowledging a profound truth: the system is unsustainable.

You cannot perpetually inflate debt and suppress interest rates without eventually destroying currency credibility. You cannot confiscate reserves, print trillions, and expect global trust to hold.

Gold has always stood outside of this game. It has no credit risk. It cannot be devalued by decree. It does not default.

As the second act of global monetary realignment begins, those who act early—who reclaim sovereignty over their savings—will not just preserve wealth.

They will protect freedom.

Own real assets. Outside the system. In your name.

🔐 Get Your Free Gold Guide!