🏆 Gold Surpasses the Euro: A New Era for Reserve Assets

Gold Overtakes the Euro as the #2 Global Reserve Asset — Here’s Why That Matters

In a historic reshuffling of global financial priorities, gold has officially overtaken the euro to become the second-largest reserve asset in the world—second only to the U.S. dollar. This isn’t a symbolic gesture. It’s the result of a deep and deliberate shift in how central banks, especially in emerging markets, are managing risk, sovereignty, and long-term security.

This change is seismic—not just for reserve managers, but for everyday investors, savers, and those hedging against systemic fragility.

Here’s what’s behind the move—and why it marks a major turning point in global finance.

📈 Record-Breaking Central Bank Demand

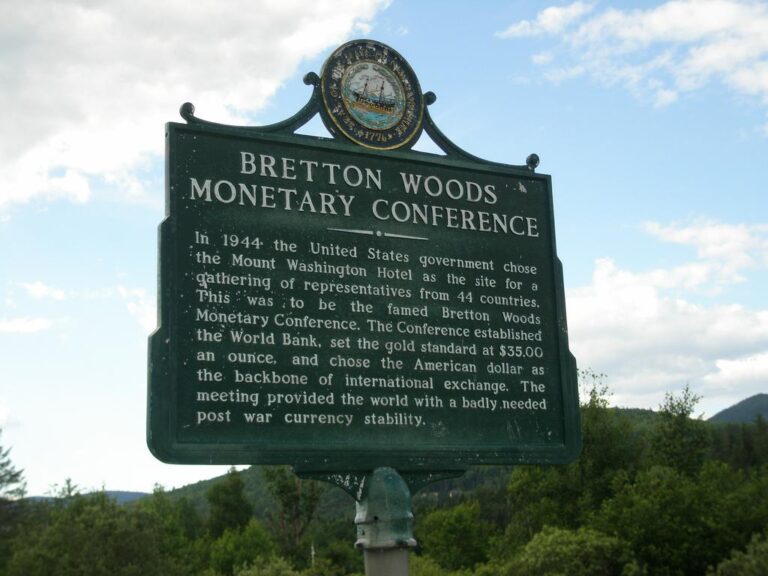

For the third year in a row, central banks bought over 1,000 tonnes of gold in 2024. That’s more than double the average pace of the 2010s. We’re now approaching a global gold reserve total of 36,000 tonnes, inching toward the post-Bretton Woods peak of ~38,000 tonnes.

From China and India to Turkey, Singapore, and Poland, the message is clear: Gold is once again being treated as money.

The reason? Security—not just financial, but geopolitical.

🌍 Gold Now Makes Up 20% of Official Reserves

According to recent data from the ECB and World Gold Council, gold now accounts for approximately 20% of total global reserves, overtaking the euro’s 16% share. The U.S. dollar still dominates at 46%, but gold is now solidly in second place—a remarkable feat for an asset with no yield and no counterparty.

This trend underscores a growing global disillusionment with fiat currencies and their central bank stewards.

🛡️ The Geopolitical Hedge

So why are countries turning to gold now?

Because gold, unlike fiat currencies:

- Cannot be frozen by sanctions

- Cannot be debased by foreign policy

- Cannot be deplatformed from SWIFT or global payment systems

In a world where reserve assets can be weaponized—as seen in the freezing of Russia’s foreign exchange reserves—gold is the ultimate neutral asset.

It’s a hedge not just against inflation, but against exclusion.

A recent World Gold Council survey revealed that central banks now view gold as:

- A long-term store of value

- A strong performer during crisis periods

- A key diversifier in reserve portfolios

In other words: Gold offers strategic protection, not just financial return.

📉 De-Dollarization: Slow but Steady

While the U.S. dollar remains the dominant reserve currency, its supremacy is no longer uncontested. The dollar’s share of global reserves has declined steadily over the past two decades, and the aggressive use of sanctions and financial tools by Western governments has caused many countries to look for alternatives.

Gold is increasingly filling that void—not as a direct substitute for currency in trade, but as a counterweight in reserve portfolios.

In many ways, gold is now functioning as the anchor asset of a multipolar world.

💵 What About the Euro?

The euro’s fall to third place is especially notable given that it was once touted as a future rival to the U.S. dollar.

Today, however, the euro:

- Is perceived as politically fragmented

- Has limited international reach

- Is not seen as sanction-neutral

Even the European Central Bank has acknowledged gold’s rise and the euro’s decline in global reserves—a rare public admission that the geopolitical winds have shifted.

📊 Gold Prices Reflect the Shift

The surge in institutional demand has pushed gold prices to record highs in 2024, peaking near $3,500/oz. Even after a modest pullback, gold remains one of the best-performing major assets in 2024 and early 2025.

Meanwhile, the U.S. Dollar Index has slipped ~8% since early 2025, further adding fuel to gold’s rise.

With inflation concerns lingering and real yields softening, the investment case for gold is as strong as it’s been in years.

⚖️ Supply-Side Constraints

Interestingly, even with prices at historic highs, gold production has not meaningfully increased. New mine development is slow, and geopolitical challenges make gold exploration riskier than ever.

At the same time, central banks may be approaching a natural plateau in their gold allocations. After three years of record purchases, further increases may be modest—but the base is now permanently higher.

In short: The floor has risen, even if the ceiling is uncertain.

🔮 What Comes Next?

If current trends hold, we may be entering a new era where:

- Gold becomes a strategic reserve requirement, not a tactical allocation

- Emerging economies lean into gold as a trustless store of value

- Sovereign wealth funds follow central banks into greater gold allocations

Critically, this trend is not about returns. It’s about resilience.

In a global system increasingly defined by financial fragmentation, political polarization, and economic warfare, gold is proving to be a universal language of trust.

🧭 Final Thought: Gold Is No Longer Plan B

For decades, gold was treated as an old-world relic—something central banks held out of tradition more than necessity.

No more.

Gold has now reclaimed its rightful place as the #2 reserve asset on Earth—and unlike fiat currencies, it doesn’t rely on trust in politicians, central bankers, or global institutions.

In a world that’s short on trust, that’s worth everything.

Invest accordingly.

The GoldBroker.com Team

📬 Questions about buying physical gold and securing it outside the banking system?

We’re here to help: | [Explore Our Options]