Basel III, Gold, and the New Monetary Order

June 17, 2025

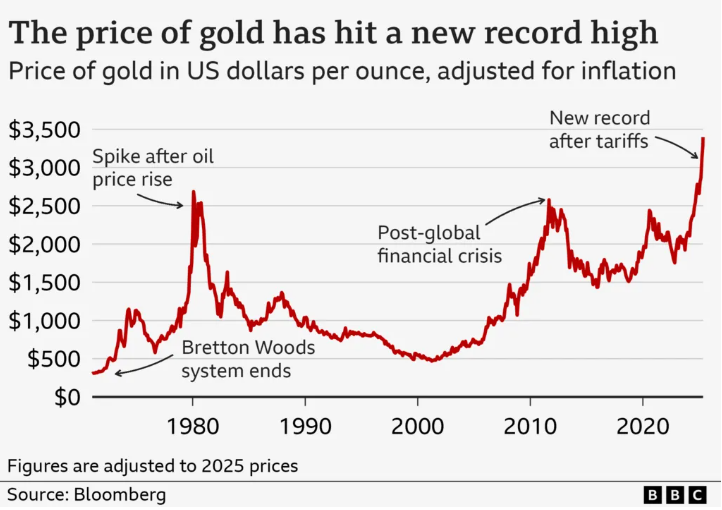

While much of the financial media continues to focus on central bank interest rate decisions and short-term inflation metrics, a quieter transformation has been unfolding—one that could change the role of gold in the global financial system for decades to come.

This transformation is being guided, in part, by Basel III, a set of international banking regulations that may appear technical at first glance, but carry significant long-term implications for the price of gold, its role in financial markets, and the architecture of the global monetary system.

At Gold-Broker.com, we believe understanding these dynamics is essential for investors seeking to protect their wealth and gain exposure to the structural shift already underway. Basel III is not merely about banking regulation—it is about the reemergence of physical gold as a cornerstone of global financial stability.

What Is Basel III?

Basel III is a framework of banking regulations developed by the Bank for International Settlements (BIS) in response to the 2008 financial crisis. Its goal is to strengthen the resilience of the banking sector by improving capital requirements, leverage ratios, and liquidity coverage.

The BIS, often described as “the central bank for central banks,” sits at the heart of the global financial system. Its guidance affects how banks lend, manage risk, and hold reserves. Basel III, implemented in stages over more than a decade, has been gradually forcing financial institutions to rethink the quality and composition of their assets.

Among its key pillars:

- Enhanced capital adequacy ratios

- Stricter liquidity coverage and funding requirements

- A new metric called the Net Stable Funding Ratio (NSFR)

But perhaps the most significant change from the perspective of gold investors is this: under Basel III, physical gold held on an allocated basis is now treated as a “zero-risk Tier 1 asset.”

A Game-Changer for Gold

Under Basel III, the Net Stable Funding Ratio (NSFR) requires banks to maintain a stable funding profile in relation to their asset composition. This is a major departure from pre-2008 practices, where short-term liquidity and leverage ruled the day.

In this new framework, physical gold—that is, gold that is fully allocated, identifiable by serial number, and stored securely—is now recognized as equivalent to cash or sovereign bonds in terms of risk weighting. This means that banks holding physical gold no longer need to offset it with additional capital, making it a safe and attractive reserve asset.

By contrast, unallocated gold positions—common in the paper gold markets—are penalized under the new rules, as they are considered riskier and require higher capital reserves. This fundamentally alters the economics of trading gold on a synthetic or fractional basis.

In simple terms: physical gold is being elevated, and paper gold is being marginalized.

The Decline of the Paper Gold Market

The gold market has long been dominated by paper-based derivatives—futures contracts, unallocated accounts, and synthetic ETFs that do not guarantee delivery of physical gold.

For years, critics have argued that these instruments allowed the price of gold to be manipulated or suppressed, since the volume of paper contracts dwarfed the amount of physical gold available for delivery. This created a market disconnected from the fundamentals of physical supply and demand.

Basel III undermines this system.

Under the NSFR, bullion banks and other financial institutions can no longer carry large unallocated positions without incurring substantial capital costs. As a result, many are being forced to:

- Reduce their paper gold exposure

- Convert positions to fully allocated physical gold

- Or exit the gold market altogether

This is leading to a structural tightening of the gold market. Liquidity in unallocated accounts is declining, and premiums for physical delivery are rising. More importantly, the ability to create artificial supply via paper instruments is diminishing.

This trend supports what we at GoldBroker have long advocated: If you don’t hold your gold in physical form, outside the banking system, you don’t truly own it.

Central Banks Are Accumulating

If there were any doubts about gold’s renewed role in the global monetary system, one only needs to follow the actions of central banks.

In 2022 and 2023, central banks purchased over 1,000 tonnes of gold annually, and that pace has continued into 2024 and 2025. These are the highest levels of central bank gold buying in over half a century.

Why the sudden rush?

- Hedging against currency debasement

- Diversifying away from the U.S. dollar

- Increasing monetary sovereignty

- And now, under Basel III, strengthening their reserve portfolios with zero-risk Tier 1 assets

From China and Russia to India, Turkey, and Brazil, central banks in the Global South are repositioning their reserves with a clear focus: gold, not bonds.

Meanwhile, nations are repatriating gold from foreign vaults—a sign of diminishing trust in the global custodial system and a renewed emphasis on direct control over monetary reserves.

A New Global Monetary Regime

Basel III does not exist in isolation. It is part of a broader realignment of the global financial system—a shift away from the U.S.-led, dollar-centric model toward a multipolar world where gold, commodities, and local currencies play a larger role.

We are witnessing the early stages of a new monetary order, with three major pillars:

1. The End of the Petrodollar Era

The dominance of the dollar as the global reserve currency is being challenged. Nations are now settling energy and commodity trades in non-dollar currencies—including gold. The BRICS+ alliance has openly discussed creating new reserve assets backed by real resources.

2. The Rise of Hard Asset Reserves

Basel III promotes the use of hard, liquid assets like gold in financial portfolios. This aligns with the desire of central banks and sovereign wealth funds to de-dollarize and secure assets with no counterparty risk.

3. The Fragmentation of Trust

The 2022-2024 period revealed the weaponization of financial systems—from SWIFT exclusions to the freezing of sovereign reserves. As trust in Western-dominated institutions erodes, gold is being reembraced as the ultimate neutral store of value.

What This Means for Investors

For Gold-Broker clients and readers, these trends affirm what we’ve long believed: owning physical gold is no longer a hedge—it is a strategic position in the emerging financial order.

Here’s what investors should consider in light of Basel III:

✔ Physical Allocation is Critical

The reclassification of physical gold means that allocated holdings—stored securely in your name, with direct ownership—are now favored not only by prudent investors but by regulatory frameworks.

✔ Paper Instruments Carry Growing Risk

Unallocated gold accounts, gold ETFs that don’t guarantee physical delivery, and futures-based exposure are becoming increasingly fragile. Liquidity is thinning, and capital costs are rising.

✔ Premiums Will Reflect Real Scarcity

As paper markets contract, the price of physical gold will reflect actual demand and supply. We expect growing divergence between spot prices and premiums for vaulted gold.

✔ Central Bank Behavior is a Signal

When central banks act in unison, it’s worth paying attention. Their accumulation of gold suggests a strategic, long-term positioning—and individual investors would be wise to follow suit.

GoldBroker: A Secure Path to Sovereign Wealth

At Gold-Broker.com, we enable our clients to:

- Purchase fully allocated, physical gold

- Store it outside the banking system, in their name

- Choose from secure vaults in Switzerland, Singapore, the U.S., and Canada

- Access their holdings directly, with no intermediation or paper proxies

We believe that in a world of rising financial risk, gold is not merely a commodity—it is a monetary asset, and a vital tool for wealth preservation.

Basel III confirms this view. The rules have changed. The future belongs to those who act early and decisively.

Final Thoughts

The implementation of Basel III is a turning point in monetary history. While the mainstream financial world continues to operate on outdated assumptions, the global regulatory structure is quietly acknowledging gold’s rightful place in the system.

As paper gold erodes and physical gold is elevated, investors have a simple choice:

- Stay within the unstable, debt-laden fiat system

or - Step outside of it—by holding real, physical, sovereign gold

At Gold-Broker.com, we are here to help you make the second option a reality.

Protect your wealth with allocated physical gold.

Open an account with Gold-Broker.com today