America’s Silent Takeover: How Washington Turned Argentina’s Collapse into a Strategic Victory — and Why Gold Is the Only Refuge Left

October 2025

When the United States Treasury announced a $20 billion “currency swap framework” with Argentina last week, financial media reported it as a lifeline. Argentina, they said, was facing a liquidity crunch; the U.S. stepped in to stabilize a friendly government and prevent a broader emerging-market contagion.

But beneath the official statements lies a deeper, more uncomfortable reality — one that speaks volumes about the state of global finance, the decline of monetary sovereignty, and the growing dominance of the dollar’s political machinery.

And it’s a story that ultimately reaffirms the timeless reason why gold remains the last safe store of value in a world of fiat manipulation and geopolitical opportunism.

The Setup: A Nation on the Edge

Argentina’s troubles were not new. For decades, the country has cycled through currency crises, IMF bailouts, capital controls, and populist experiments. When Javier Milei, a libertarian economist, took office promising to “end the central bank” and restore market confidence, many saw him as Argentina’s last chance to escape the inflationary spiral.

At first, the market rallied behind him. He slashed subsidies, cut public spending, and proposed a radical “dollarization” of the economy. Investors applauded. Washington offered kind words.

But underneath the optimism, Argentina’s reserves were collapsing. Inflation, though slightly lower, remained above 200%. Debt maturities were looming. Export revenues — especially from soybeans — were shrinking as China shifted purchases to Brazil and Argentina itself.

It was a perfect storm — and one Washington could see forming months in advance.

The Implosion: From Reform to Ruin

By early October, the Argentine peso was in freefall, despite frantic interventions by the central bank. The Milei government, having exhausted its tools, was forced to plead for foreign support. On cue, U.S. Treasury Secretary Scott Bessent announced the swap framework and confirmed what stunned observers:

“Today we directly purchased Argentine pesos.”

This was not merely a financial gesture — it was a statement of control. For the first time, the U.S. openly intervened in a foreign currency market to prop up an allied government’s domestic unit. The implications were historic.

What this means, in simple terms, is that Argentina — once again — surrendered monetary sovereignty. The United States now sits effectively inside Argentina’s central bank operations, dictating terms of liquidity and access to the global dollar system.

But Washington’s timing wasn’t coincidental. It was strategic orchestration.

The Strategy: Manufactured Dependency

To understand what just happened, one must look at the broader playbook.

Argentina is home to some of the world’s largest lithium deposits, critical for the electric vehicle and energy storage industries. It also possesses vast shale gas reserves in the Vaca Muerta basin, one of the most promising energy frontiers in the Western Hemisphere.

These are the raw materials of the 21st century economy — and Washington knows it.

Meanwhile, China’s Belt and Road investments had already made deep inroads across Latin America. Beijing had been financing infrastructure, offering yuan-based trade credit, and securing long-term access to critical minerals. Argentina’s previous administrations leaned heavily toward Beijing and Moscow.

When Milei was elected — running explicitly on a pro-West, anti-China platform — the geopolitical opportunity was too valuable for Washington to ignore. Supporting Milei wasn’t just about ideology. It was about capturing Argentina before China did.

The Execution: Economic Entrapment

The new “swap” agreement is, at its core, a mechanism for dependency.

Here’s how it works:

- The U.S. provides dollar liquidity through the Treasury and Federal Reserve system.

- Argentina pledges its local assets and future foreign exchange revenues as collateral.

- In practice, the U.S. gains significant influence over Argentina’s monetary and fiscal policy decisions.

It’s not aid. It’s financial colonization in modern form.

And this pattern is not unique to Argentina. We’ve seen it in Ukraine, where international “aid” comes with strict financial conditions tied to Western lenders. We’ve seen it in Europe, where the ECB and IMF effectively dictate fiscal rules to member states.

Each instance reinforces a single truth: the dollar system is no longer just a currency regime — it’s a tool of governance.

The Irony: “America First” Abroad

The Biden and Trump administrations may differ in tone, but both have embraced the same principle: “America First” extends beyond borders.

When the U.S. bails out a foreign government, it’s not an act of charity. It’s an investment in control.

And in this case, Washington’s move was doubly advantageous. Not only did it secure a strategic foothold in Argentina — it also deepened the pressure on U.S. farmers, who are losing exports to the very same country Washington just rescued.

China has all but abandoned U.S. soybeans, turning to Brazil and Argentina for supply. American farmers, already burdened by tariffs and weak demand, now face the added insult of watching their government stabilize their competitors.

For Washington’s policymakers, this contradiction is tolerable. For the average American producer, it’s devastating.

But for the global monetary system, it’s a warning sign: the dollar is no longer just a medium of exchange — it’s an instrument of geopolitical leverage.

The Lesson: When Fiat Becomes a Weapon

The Argentina case illustrates the terminal condition of the fiat era.

Every major government, whether in Buenos Aires, Washington, or Brussels, has learned to weaponize its currency.

- To buy influence.

- To control outcomes.

- To suppress volatility — or to unleash it when convenient.

When the U.S. Treasury can openly purchase another nation’s currency, it sends a clear message: sovereignty is conditional in a fiat world. Stability is rented, not earned.

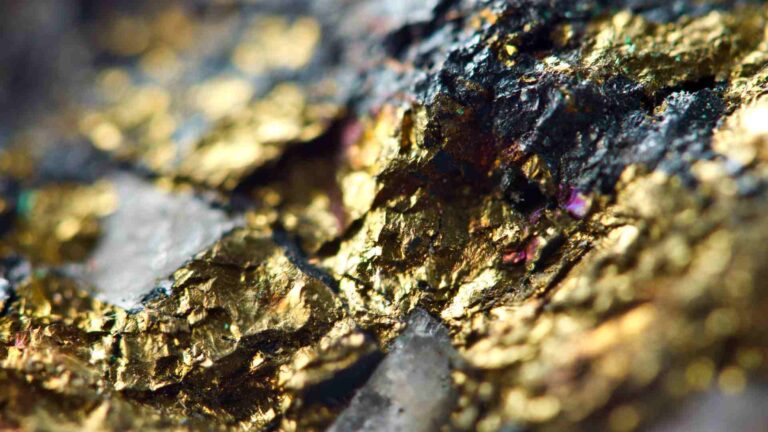

But gold doesn’t play that game.

It isn’t printed. It isn’t sanctioned. It isn’t politically conditional.

It is the final reserve asset precisely because it lies outside the system of control.

The Global Implications: The Next Wave of Dollarization

With Argentina effectively dollarized through the backdoor, other emerging markets are watching closely.

In Africa, nations like Kenya and Nigeria are struggling to maintain reserves amid dollar shortages. In Asia, several countries — from Sri Lanka to the Philippines — face similar pressures. The message is spreading: “Submit to the dollar, or face isolation.”

But this trend can’t last forever. Each new “rescue” adds to global imbalances. Every swap line, every bailout, every debt rollover piles more demand on an already overextended U.S. fiscal system.

At some point, the issuer of the global reserve currency becomes the ultimate debtor — and the world begins to look elsewhere for credibility.

That “elsewhere” has always been gold.

The Return of the Hard Asset Era

As fiat trust erodes, the monetary hierarchy is beginning to invert.

Central banks have been quietly preparing for years:

- China and Russia continue to accumulate gold reserves.

- The BRICS alliance is discussing settlement systems backed by commodities.

- Even Western nations are reconsidering their exposure to U.S. Treasury debt amid trillion-dollar deficits.

Gold’s recent surge beyond $4,000 per ounce is not just a market reaction — it’s a structural repricing of risk. Investors are no longer treating gold as a hedge. They are treating it as money itself.

And silver, historically the “poor man’s gold,” is showing signs of life too — outperforming gold on a percentage basis as industrial demand rises alongside its monetary appeal.

Argentina, Fiat, and the Final Lesson

Argentina’s implosion was inevitable. But the manner in which it unfolded — and the speed with which Washington capitalized on it — exposes the fragility of the entire global monetary order.

Every fiat system, when pushed to its limits, ends in two outcomes:

- External dependency, where sovereignty is sold for liquidity.

- Internal collapse, where inflation erases trust in the currency.

Argentina is living both at once.

The U.S. simply chose to turn its collapse into an opportunity.

But investors should see this not as a South American story — rather, as a preview of what happens when the world runs out of faith in paper promises.

Because if Argentina needs $20 billion to defend a broken currency, and the U.S. needs $3 trillion a year to roll over its own debt, then who exactly is solvent?

Conclusion: The Only Asset Without Counterparty Risk

In an age where currencies are used as weapons, and monetary “rescues” are disguised as acquisitions, the role of gold is clearer than ever.

It is the only asset that cannot be printed, manipulated, or sanctioned.

It is the only true measure of value left standing when politics consumes economics.

Argentina’s surrender to dollar control may delay its crisis — but it cannot erase it. Nor can it erase the fundamental arithmetic of a global system drowning in debt, leverage, and artificial liquidity.

As nations barter sovereignty for survival, one truth endures:

Those who hold real assets will outlast those who hold paper claims.

In the end, the story of Argentina is the story of fiat itself — a system that survives only by replacing collapse with control.

And that’s precisely why gold, as ever, remains the foundation of financial freedom.

Gold-Broker.com