Brace for Impact: Gold Is No Longer a Hedge—It’s a Lifeboat

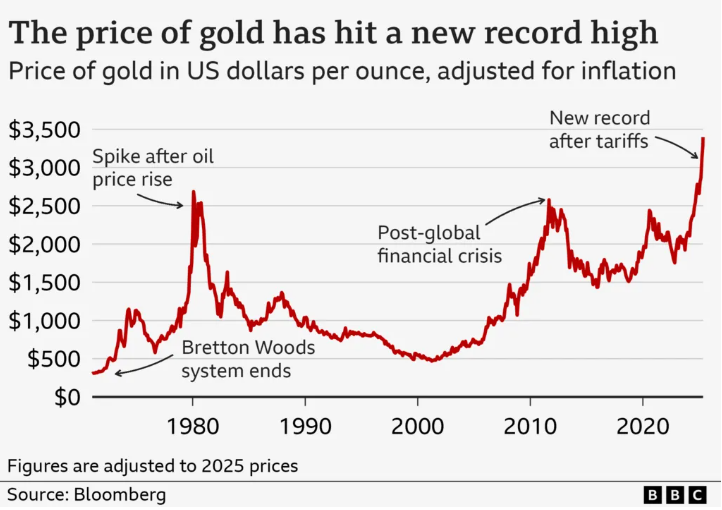

Just this week, industry analysts forecasted that gold could reach $4,000/oz and silver $40/oz by year’s end, citing rising global instability and accelerating shifts in the financial system.

At Gold-Broker.com, we’ve seen trends like this building for years—but now, the pieces are moving faster than ever.

🧭 The Macro Forces Aligning Behind Gold

- Geopolitical Chaos: From Eastern Europe to the Middle East, global flashpoints are driving capital into hard assets.

- De-Dollarization: Nations are quietly turning away from the U.S. dollar—and piling into gold.

- Central Bank Gold Rush: 2024 saw record gold purchases by central banks. 2025 is on track to break it again.

- Inflation & Currency Risk: Fiat erosion is no longer theoretical—just look at the headlines from Argentina, Japan, and beyond.

These aren’t isolated events—they’re signals of a global monetary shift already in motion.

🔒 Why Physical Gold Is More Critical Than Ever

Paper claims and ETFs are easy. But in times of crisis, only physical ownership matters.

- No counterparty risk.

- No banking system exposure.

- No digital access required.

When volatility spikes, owning vaulted, insured, and deliverable metal is not a luxury—it’s a necessity.

⚡ Our Perspective

Is $4,000 gold a wild forecast? Maybe.

Is it possible in a world defined by uncertainty, trust erosion, and fiat overreach?

Absolutely.

The question isn’t if gold will rise.

It’s whether you’ll be positioned before or after it does.

📈 What You Can Do Now

- ✅ Buy physical gold and silver, directly and securely via your Gold-Broker.com account.

- 🛡️ Review your existing holdings—are you overexposed to financial system risk?

- 📥 Download our Free Guide: “Gold in a Time of Crisis: How to Protect and Grow Wealth in 2025”

[Get the Guide] | [Buy Gold & Silver] |

Stay informed. Stay independent. Stay ahead.

—

The Gold-Broker.com Team