Gold at $3,500: Golden Opportunity or Glittering Risk?

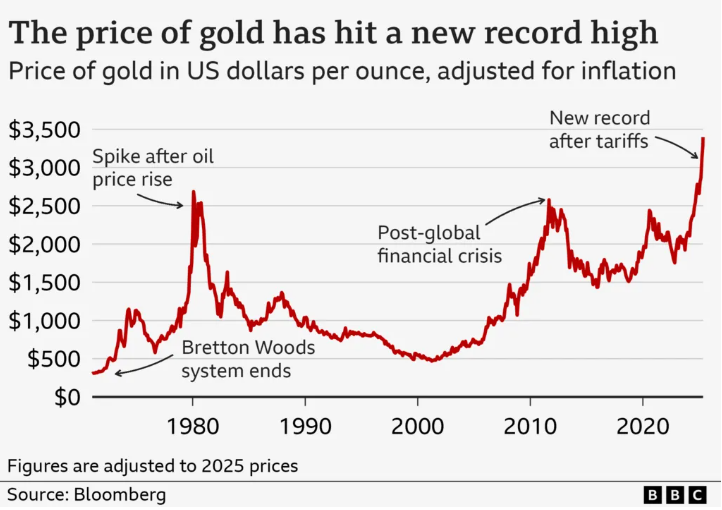

Gold has taken center stage again—surging more than 40% over the past year and recently crossing $3,500 per troy ounce, an all-time inflation-adjusted high. For many, it’s a signal of strength and safety in uncertain times. For others, it’s a flashing warning light reminiscent of past bubbles.

So what’s really behind the latest gold rush—and what does it mean for investors like you?

🧭 Why Gold Is Surging

Several forces are converging to fuel gold’s remarkable rally:

Geopolitical instability: From US-China tensions to the war in Ukraine, global uncertainty has driven investors toward safe-haven assets.

Dollar disillusionment: Nations like China, Turkey, and Russia have been aggressively buying gold to reduce reliance on the US dollar.

Central bank demand: Net gold purchases by central banks have more than doubled since 2022.

Inflation & rate fears: With persistent inflation and calls for rate cuts, gold has emerged as a perceived hedge.

Fear of missing out (FOMO): As prices set new records, retail and institutional investors are rushing in.

🏛️ Gold vs. Other Assets

Unlike stocks and bonds, gold doesn’t pay dividends or yield. It’s not designed to produce income—but it does offer value preservation in times of volatility. Think of it as insurance, not a profit engine.

“Gold can’t be printed by central banks or conjured out of thin air.”

—Russ Mould, AJ Bell

📉 Could the Bubble Burst?

History reminds us that gold’s meteoric rises are often followed by painful corrections:

In 1980, it dropped 65% in 18 months.

After its 2011 peak, it fell over 35% within two years.

Some analysts now warn the market may be overheating:

“Short-term speculating can backfire… Investors shouldn’t put all their eggs in a golden basket.”

—Susannah Streeter, Hargreaves Lansdown

🧠 What Smart Investors Are Doing

Gold is a useful hedge, but not a standalone strategy. The best investors are:

✅ Holding gold as part of a diversified portfolio

✅ Avoiding emotion-driven, top-chasing trades

✅ Watching macro signals like rate policy, geopolitical shifts, and dollar trends

📈 Forecasts at a Glance

Source

2025 Forecast 2026 Forecast

Goldman Sachs $3,700/oz $4,000–$4,500/oz

Morningstar (Bear Case) $2,300–$1,820/oz —

✨ Final Word from Gold-Broker.com

Whether you view gold as a lifeboat or a bandwagon, remember this: it’s a tool, not a treasure map. At Gold-Broker.com, we believe clarity, diversification, and discipline are your real precious metals.

Interested in refining your portfolio?

Let us help you calibrate your strategy with intelligent gold exposure—balanced with growth, yield, and stability.

📩 [Contact us to review your allocations.]

Until next time,

– The Gold-Broker Team