Gold, Geopolitics & the End of Dollar Decline: What the IMF, CFR, and 2025 Bilderberg Meeting Reveal

In the silent corridors of global power, something significant is shifting.

Central banks are buying gold, major think tanks are planning for post‑dollar futures, and elite gatherings have placed financial realignment center stage.

As gold continues its ascent, this newsletter exposes the hidden signals from three critical global actors:

- The International Monetary Fund (IMF)

- The Council on Foreign Relations (CFR)

- The 2025 Bilderberg Meeting, held in Stockholm this June

What they’re saying in private may define the monetary order—and your financial future.

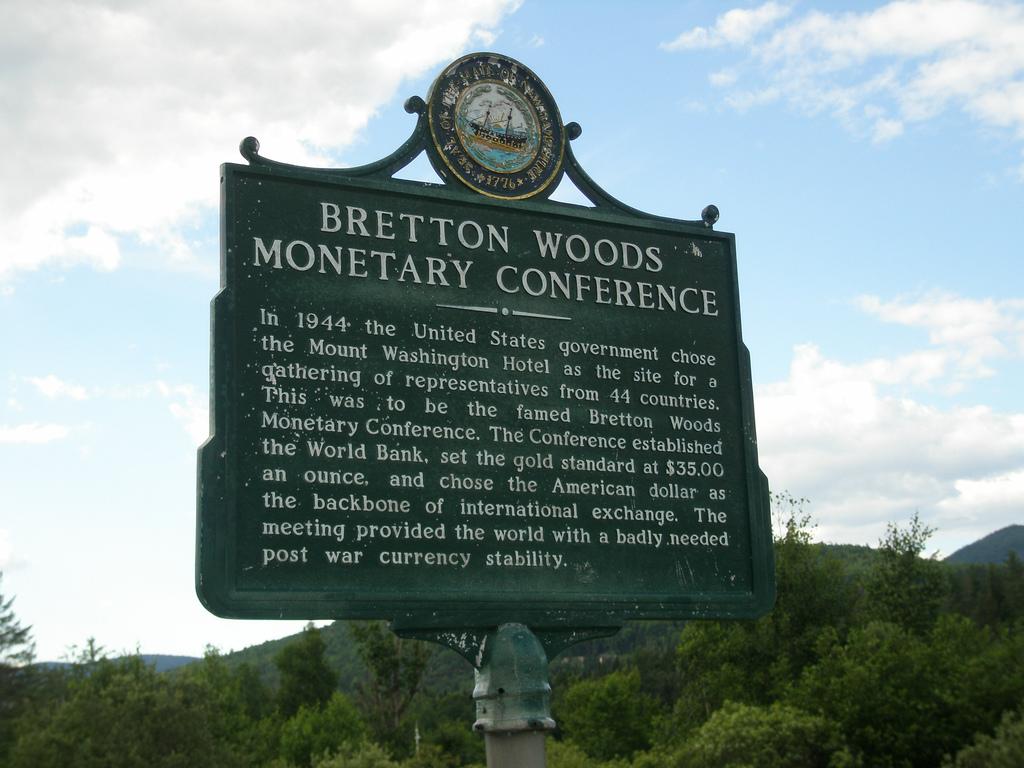

I. IMF: From Bretton Woods to “Neutral Reserve Assets”

The IMF’s roots trace back to Bretton Woods, the gold‑anchored system linking the dollar to global stability. When Nixon cut the dollar‑gold peg in 1971, the IMF pivoted to managing a fiat‑based financial order.

But recent publications and internal strategy sessions indicate a renewed interest in more stable, trust‑based alternatives.

In its 2025 Global Policy Agenda, the IMF reaffirmed its role in guiding macroeconomic stability and currency policy—notably amidst rising fragility in the international system.

Private signals from the IMF include:

- Central banks accumulating over 1,000 metric tons of gold in 2024—their most since the early 1970s.

- The dollar’s global reserve share falling beneath 58%, hitting record lows.

- Growing advocacy for Special Drawing Rights (SDRs) as part of an SDR‑based multi‑reserve architecture.

- Emerging discourse around “neutral reserve assets”—implicitly referencing gold as a cornerstone alternative.

The IMF appears to be preparing a resilient scaffold for a post‑fiat future—one where gold and SDRs provide real ballast.

II. Council on Foreign Relations: Architecting the New Monetary Blueprint

The Council on Foreign Relations serves as a de facto think tank for American strategy. Its membership—Treasury, Fed, State, military, finance—allows it to incubate pivotal public policy before it goes mainstream.

Internal CFR discussions have charted a detailed path:

- The petrodollar system is unraveling as oil producers like Saudi Arabia embrace pricing in yuan and gold.

- Sanction backlash is prompting de‑dollarization, especially among BRICS and non-aligned nations.

- CBDCs are being promoted as not just financial tools, but as instruments of U.S. monetary influence.

- They’re planning for a “digital Bretton Woods”—a new settlement framework possibly anchored by gold and digital asset infrastructure.

- They’re modeling future scenarios involving capital controls, inflation, and fiscal crisis—all of which include gold as a stabilizing reserve.

The CFR is not sounding alarms—they’re drafting blueprints.

III. 2025 Bilderberg Meeting: Stockholm’s Silent Signal

From June 12–15, 2025, over 130 global leaders, including NATO’s Mark Rutte, Microsoft’s Satya Nadella, and U.S. Army Europe commander Christopher Donahue, gathered under the Chatham House Rule in Stockholm on invitation by the Wallenberg family.

Key agenda themes included:

- Trans‑Atlantic relations, US economy, Europe-Ukraine instability

- Middle East conflict, “Authoritarian Axis” tensions

- Defence innovation, AI, nuclear proliferation

- Critical minerals, energy geopolitics, migration & depopulation

Noticeably missing from previous years—explicit debate about monetary fragmentation, gold’s role, and US dollar redesign. Yet the subtext was clear:

- Energy and critical minerals intersect with economic realignment.

- AI and defence innovation reflect changes in economic control and sovereign technical sovereignty.

- “US economy” was debated in the context of decoupling from China, inflation resilience, and alternative reserve strategies.

- Top figures—Peter Thiel, Robert Lighthizer, JD Vance—voiced a strategic Western reset away from Chinese financial systems.

While gold wasn’t billed as a session title, the real themes—energy de‑risking, monetary fragmentation, and geopolitical autonomy—are outcomes driven by gold‑based strategies.

The Bilderberg 2025 meeting wasn’t about gold in name—it was about positioning assets for the post‑fiat era.

IV. Why This Shift Impacts You

These aren’t theoretical signals. They mean three tangible changes for Americans:

1. Inflation & Currency Weakness

Loss of global demand for dollars means a downgrade of U.S. borrowing advantages. Expect:

- Higher inflation

- Rising interest rates

- Pressure on purchasing power

2. Eroding Global Influence

If oil, reserves, and trade settlement shift to gold, yuan, or SDRs, Washington’s financial leverage weakens dramatically, diminishing both diplomacy and defense budget scope.

3. Domestic Financial Controls

Emerging tools may include:

- Private gold ownership limits and reporting mandates

- Offshore asset regulation

- Capital movement caps during crises

- “Windfall asset” taxes targeting gold, crypto, and foreign-currency holdings

Gold investors in 2025—while legal—should prepare for scrutiny far beyond today’s norms.

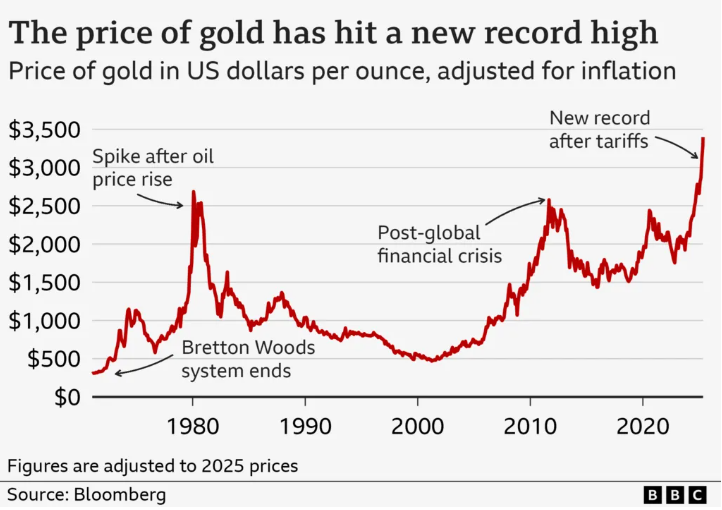

V. Gold’s Modern Comeback: Data Speaks

This is no mere hype—it’s visible in the data:

- 1,000+ metric tons of central bank net purchases in 2024 —the highest level in half a century.

- Retail demand in the U.S. rose 37% year-over-year.

- Paper gold ETFs have experienced outflows, while physical bullion stacks have surged.

- Dollar reserves dropped below 58%—the lowest measured level.

This is not cyclical—it’s systemic. Gold is regaining its role as the ultimate reserve asset.

VI. Preparing Wisely in the Transition Era

At Gold‑Broker.com, we believe action—grounded in prudence—is essential. Here’s your strategic blueprint:

✅ Own physical bullion.

ETFs are convenient; physical is sovereignty.

✅ Store it safely.

Choose vaults in Switzerland, Singapore, or Canada, outside domestic banking systems.

✅ Diversify currency exposure.

Complement gold with smart hard‑currency holdings and energy‑linked assets.

✅ Stay ahead of change.

Reporting rules evolve quickly. The earlier you hold, the fewer hassles later.

✅ Guard discretion.

Asset surveillance increases. Be proactive, discreet, compliance‑ready.

VII. Conclusion: The Reshaping Has Begun

To recap:

- The IMF is prepping for a more stable, gold-inclusive reserve architecture.

- The CFR is designing policy frameworks for a de‑dollarized, digital reserve world.

- The Bilderberg elite in Stockholm just layered in strategic asset shift—subtly, but violently purposeful.

Gold is no longer just a hedge—it’s the cornerstone of a forthcoming monetary reformation.

For you, it’s not speculation—it’s survival and independence.

By building a foundation in physical gold, stored securely, internationally, and currently, you’re gaining sovereignty in a world quietly restructuring its financial future.

Gold is real insurance—your insurance—against systemic collapse.

—

Gold‑Broker.com Team