JP Morgan Just Bought $4 Billion in Physical Gold—Delivered to HQ. Shouldn’t You Be Asking Why?

The Smartest Guys in the Room Just Took Delivery of $4 Billion in Physical Gold.

You read that right.

In a financial world increasingly built on leverage, derivatives, and digits on screens, JP Morgan Chase & Co.—the most powerful bank in America—just made a throwback move straight out of the 20th century: taking physical delivery of an estimated 2.2 million ounces of gold bullion worth over $4 billion, delivered directly to their New York City headquarters.

This is not a drill. This is not another ETF. This is not a COMEX derivative roll. This is real gold—bars, vaults, and security details included.

And it begs the question:

What does JP Morgan know that the rest of the market doesn’t?

Let’s break it down—and more importantly, understand what this means for you.

🏦 JP Morgan’s Move: A Return to Tangible Value

Gold has always played a quiet but critical role on Wall Street’s balance sheets, even if the mainstream media prefers to cover crypto rollercoasters and meme stocks.

But now, the biggest U.S. bank by assets just sent an unmistakable signal: they want physical gold, not paper promises.

Why? Here are four key reasons to consider:

1. Rising Counterparty Risk

In a market loaded with synthetic financial instruments, from credit default swaps to rehypothecated gold futures, counterparty risk has never been higher.

When JP Morgan takes physical delivery of billions in bullion, it’s making a very public statement:

“We don’t trust IOUs. We want the asset itself.”

With over $400 trillion in global debt and multiple major banks still underwater on commercial real estate and bond portfolios, even insiders are bracing for a credit event that could ripple through the system.

Physical gold has no counterparty risk. That’s why it’s priceless in a time of doubt.

2. De-Dollarization Is Accelerating

JP Morgan’s gold acquisition also aligns with a growing trend: the global move away from the U.S. dollar as the world’s reserve currency.

In 2024 alone:

- China and Brazil began settling energy contracts in yuan.

- The BRICS alliance expanded its gold reserves and trade settlements.

- Central banks worldwide added over 1,200 tonnes of gold—a record.

Even Fed Chair Jerome Powell admitted earlier this year that “a multipolar reserve system is no longer a hypothetical.”

If you’re holding dollars, you’re holding a depreciating claim on future productivity. If you’re holding gold, you’re holding money that outlasts empires.

JP Morgan understands this. Do you?

3. Inflation Isn’t Over—It’s Evolving

While headline CPI has cooled from its 2022 highs, the real cost of living continues to rise—stealthily and systemically.

Gold’s role as a store of value is more important than ever, especially as the Fed resumes QE Lite under the guise of “liquidity management.” Despite slowing rate hikes, the balance sheet is quietly expanding again.

Here’s the truth: fiat currency is designed to lose value over time. Gold is not.

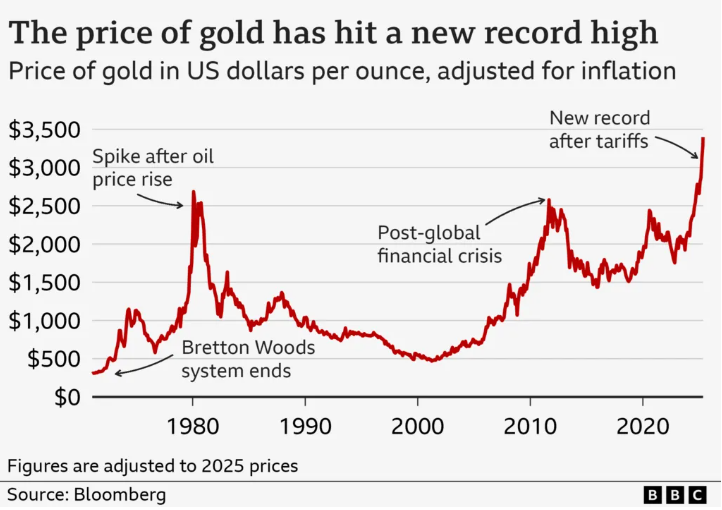

From 2000 to 2025, the U.S. dollar has lost over 50% of its purchasing power. In that same period, gold has risen over 550%.

4. The COMEX Game May Be Breaking

If you’ve followed gold markets closely, you know that the COMEX (the U.S. futures exchange where gold contracts are traded) has long operated on a fractional reserve model.

At times, there have been over 100 paper claims for every ounce of registered physical gold.

When JP Morgan—a top COMEX market-maker—takes delivery instead of just rolling over paper contracts, it suggests something fundamental is shifting.

If confidence in paper gold evaporates, there could be a massive short squeeze on physical supply.

Gold that’s not in your possession is gold that’s not truly yours.

💰 What This Means for Individual Investors

If one of the world’s most powerful financial institutions is securing physical bullion, what should everyday investors take from that?

The answer is simple:

Gold isn’t just for “doomsday preppers.” It’s for the financially literate.

For centuries, gold has been:

- A hedge against currency collapse

- A ballast during market volatility

- A store of wealth immune to political games

It doesn’t promise quick riches—but it delivers enduring purchasing power.

Now, in 2025, the world’s financial giants are returning to gold. Don’t wait for the headlines to tell you what your instincts already know.

🧠 Why Physical Gold, Not ETFs?

JP Morgan didn’t buy shares of GLD or another ETF. They didn’t “go long” on futures. They bought actual bars, trucked in and locked down.

Here’s why that matters:

| ETF Gold (GLD, IAU) | Physical Gold |

|---|---|

| Paper promise | Tangible asset |

| Subject to counterparty risk | Held outside banking system |

| Can be frozen or suspended | Fully in your control |

| Tracks price, doesn’t deliver metal | True ownership |

| Exposed to financial system failures | Immune to systemic risk |

Owning physical gold is financial self-defense. It’s what the elite do when they stop trusting the system they helped build.

🔐 Where Does Gold-Broker.com Fit In?

At Gold-Broker.com, we specialize in non-bank, fully allocated, and insured gold and silver ownership—outside the banking system and completely in your name.

When you buy through us:

- You get direct ownership, not exposure.

- Your metals are stored in secure vaults in Zurich, Toronto, New York, or Singapore.

- You can take delivery at any time.

- There is no mutualization of risk—your holdings are off-balance-sheet and not pooled with others.

Our clients range from first-time buyers to high-net-worth families, all looking for real protection, not illusions of safety.

📉 What Happens Next?

JP Morgan’s move is just the latest domino in a global reset already in motion.

- U.S. sovereign debt is approaching $40 trillion.

- Interest payments alone are nearing $2 trillion per year.

- Central banks are loading up on gold like it’s 1971 again.

And now, Wall Street’s titans are quietly preparing.

The smartest play? Follow the gold. It’s what banks, billionaires, and entire nations are doing.

Ask yourself: If gold is so “obsolete,” why are the most powerful entities in the world trying to get their hands on as much of it as possible?

✅ Take the First Step Toward Real Ownership

Whether you’re protecting a $10,000 nest egg or a $10 million estate, owning physical gold is a rational, responsible, and proven step in today’s climate.

>> Schedule a free consultation with a Gold-Broker.com advisor.

>> Or start your direct ownership today with as little as $5,000.

We don’t sell paper. We don’t store gold in fractional reserves. We deliver real wealth, real security, real ownership.

JP Morgan just confirmed what we’ve been saying for over a decade.

It’s not “if” you’ll need gold. It’s whether you’ll own it before or after the next shock hits.

Gold-Broker.com

Real Gold. Real Ownership. Outside the System.

Next Steps – Free Investor Kit

🌐 Visit us at www.gold-broker.com

📩 Email: info@gold-broker.com

Disclaimers:

Gold-Broker.com is not affiliated with JP Morgan Chase & Co. The content of this newsletter is for informational purposes only and should not be construed as investment advice. Past performance is not indicative of future results. Always consult with a financial advisor before making investment decisions.