Tariffs, Fed Signals & the Gold Horizon: June 2025 Update

By Gold‑Broker.com – June 11, 2025

🏦 1. The Beige Book: A Snapshot of Fed Disquiet

The Federal Reserve’s Beige Book (released June 4) echoes its earlier June synopsis: slower growth, persistent regional divergence, and elevated uncertainty rooted in tariffs and policy unpredictability. According to Reuters, only three of 12 districts reported growth, with the rest either flat or contracting. Anecdotes such as “companies can’t figure out the rules of this tariff game” underscore this confusion.

The report also flagged further core PCE inflation (+2.1% in April), with rising costs mainly tied to trade tensions . Even Fed Governor Adriana Kugler emphasized tariff-driven inflation risks and advocated holding interest rates at 4.25–4.50%.

Gold Implication:

A weakening economy paired with sticky inflation creates negative real-rate potential, reinforcing gold’s allure as a store of value.

📈 2. Tariff Toll: Growing Cost Pressures

- Elevated cost pressures from tariffs pervade both manufacturing and consumer goods, across all Fed districts.

- Initial tariff pass-through has been gradual, but input costs are accumulating. Retailers often rely on existing inventory buffering, but structural shifts are now evident .

Gold Implication:

Tariff-led “hidden inflation” may not fully reflect in headline CPI soon but will underscore gold’s inflation-hedging appeal.

📉 3. Consumer & Industrial Malaise

Beige Book takeaways: tepid consumer demand in several regions, manufacturing weakness, slowed new orders—all tied to tariff-/ policy‑related deferral of purchases.

Fed correspondent reports across Boston and Dallas districts confirm cautious hiring, muted retail, and hesitancy on big-ticket investments .

Gold Implication:

A bumpy economic backdrop reduces confidence in equities and increases demand for non‑correlated assets like gold.

👥 4. Labor Market: Flat, But Not Frozen

Employment remains largely flat nationally, with pockets of slowdown. Hiring freezes and cautious recruitment reflect firms shying away from expansion.

Wage growth remains modest, with fewer signs of acceleration—a softening of inflation from labour, but not consumer costs.

Gold Implication:

Flat wage and employment dynamics dampen real rates, traditionally supportive of gold.

📊 5. Fed Policy Outlook: A Delicate Balance

The Beige Book and Fed commentary confirm a policy tightrope: slowing growth vs. persistent inflation. Investors now expect rate cuts in September at the earliest—though later than previously anticipated.

With Fed Governor Kugler citing tariff-driven inflation as a key reason for holding policy steady, the Fed seems committed to data-driven caution .

Gold Implication:

If real yields hover near zero or turn negative, gold’s opportunity returns.

🌍 6. Global Gold Demand & Safe-Haven Trends

Central Bank Buying

- 2024 saw record purchases (>1,086 t), with 2025 on track for a fourth straight year above 1,000 t.

- Gold is now the second-largest reserve asset globally, surpassing the euro (20% vs. 16% share)

ETF & Retail Inflows

- Gold ETFs posted $30 bn in inflows YTD (despite a $1.8 bn dip in May)

- Q1 2025 saw a 170% spike in ETF demand; retail jewelry is down, signaling a strategic reorientation toward investment gold .

Price Floors

- Q2 gold support at ~$2,700–$2,800/oz; breaking above this prefix impedance could trigger further gains.

Gold Implication:

The trifecta of central bank accumulation, ETF inflows, and robust fundamentals form a powerful structural foundation.

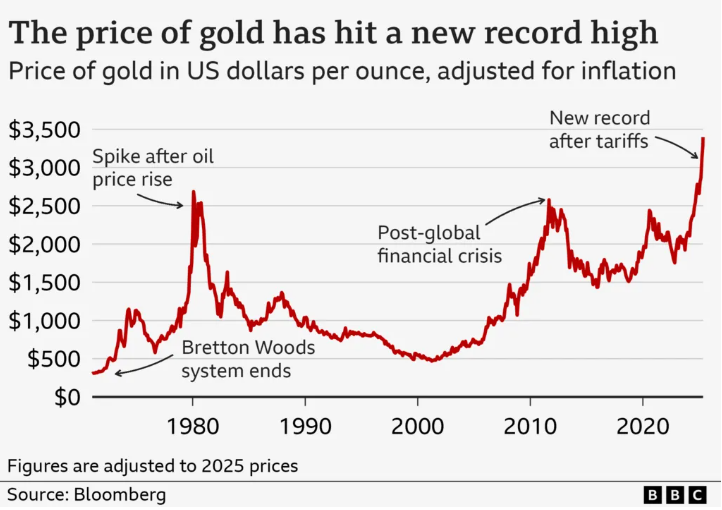

💱 7. Price Point: The Pulse of Gold

- Spot gold: ~$3,338/oz (+0.5% on June 11)

- Mining consensus forecasts: UBS and SSGA expect gold to average ~$3,200–$3,500 by mid-year; bullish tail cases see prices near $3,900 if geopolitics escalate .

- Average target for 2025 gold: ~$3,210 (+35% Y/Y)

Gold Implication:

Given current momentum and premium demand, upside toward $3,500+ by year-end is well within range.

🔍 8. Final Take: Gold in a Tariff-Stressed Economy

| Theme | Implication |

|---|---|

| Tariff shock & policy uncertainty | Inflationary pressure without growth = gold support |

| Fed policy paradox | Will the Fed cut, or hold? Real yields remain key |

| Structural demand | Central banks & ETFs are piling in |

| Price signals | Support zones holding; upside ahead |

Bottom line for gold investors:

We’re in a “Gold-likelihood bullish convergence”—a strained economy, policy flux, and enduring demand forces are aligning. Morgan’s odds: moderate scenario ($3,100–3,500), bull-case ($3,500+), all backed by both cyclical and strategic flows.

📎 Disclaimer & Next Steps

This newsletter is for information—not investment advice. For personalized guidance, consult your financial or investment advisor.

Explore more:

- Live gold pricing & commentary on [gold‑broker.com]

- Global bullion storage & precious metals insights

- Why NOW may be the time to invest in Gold – Free Investor Kit

Stay vigilant. Inflation watchers may find relief from reflation—but gold is the ultimate neutralizer when policies falter.