Tether’s Secret Gold Vault: A Private Sector Power Play or a Canary in the Fiat Coal Mine?

July 2025 Edition

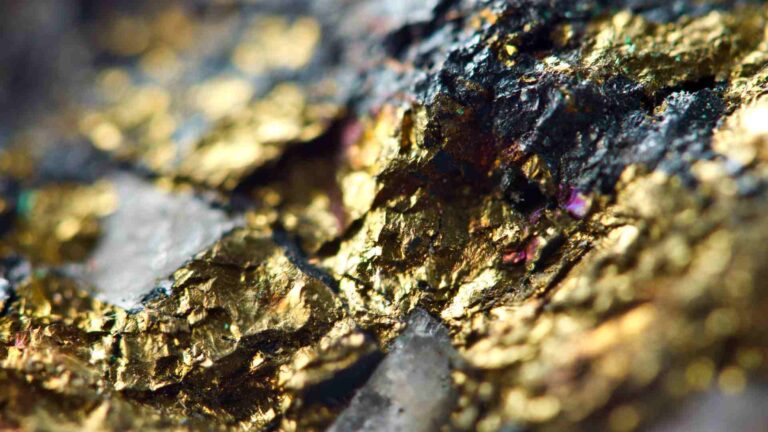

In a world where trust in traditional financial institutions is eroding by the day, a crypto firm’s quiet acquisition of 80 metric tons of physical gold is making global headlines—and raising critical questions.

On July 8th, Bloomberg revealed that Tether Holdings Ltd., the company behind the world’s largest stablecoin (USDT), has amassed $8 billion worth of gold and placed it in a privately controlled Swiss vault, inaccessible to banks or governments. It’s a bold—and for some, disturbing—demonstration of how the private sector is moving to secure hard assets in anticipation of increasing financial instability.

But what does this mean for the global gold market, digital finance, and—most importantly—your wealth preservation strategy?

💰 Tether’s Golden Bet

The crypto ecosystem isn’t known for physical assets. It trades on decentralization, speed, and code—not vault doors and metal bars. But Tether’s move is a stark departure.

According to Bloomberg, the company has transferred nearly 80 tons of physical gold into a secure vault it owns outright in Switzerland. The holdings make up about 5% of its $159 billion in reserves backing USDT. This is no speculative dabble: it’s a foundational reallocation toward a real-world, trustless store of value.

The gold is also used to back Tether’s XAUT token, a gold-backed stablecoin issued at a rate of 1 ounce per token, pegged to physical gold stored in this very vault.

At time of publication, XAUT has a market cap of ~$820 million, backed by about 7.7 metric tons. The rest? Strategic reserve—likely parked there for economic or geopolitical contingency, or perhaps a future expansion of XAUT itself.

🧠 Why Now? Timing Is Everything

Why would a crypto giant—known for trading speed and regulatory arbitrage—move into a slow, heavy, expensive asset like gold?

Because the global macro picture is unraveling.

- Rising Sovereign Debt: The U.S. crossed $35 trillion in national debt this year, with interest payments eclipsing defense spending.

- Inflation is Sticky: Despite cooling CPI prints, “real-world inflation” remains embedded in energy, housing, and food—areas governments don’t want to talk about.

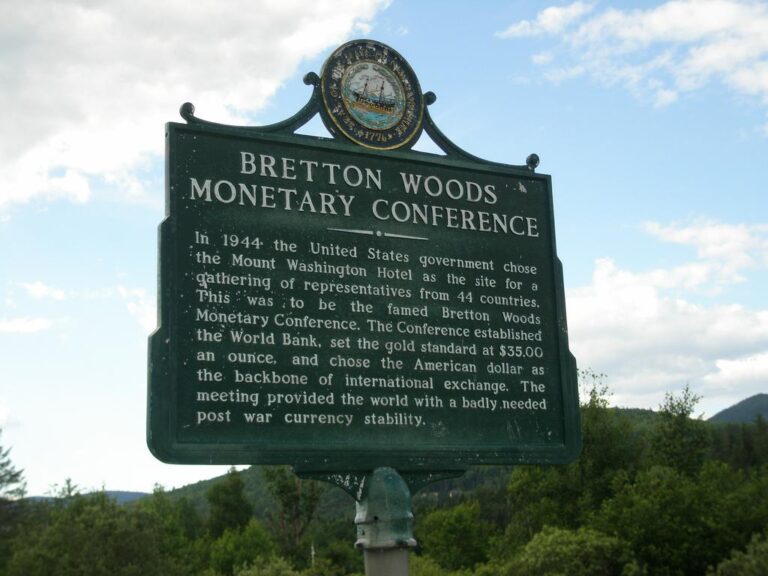

- Weaponized Money: The 2022 seizure of Russia’s FX reserves showed that even sovereign central banks aren’t immune to expropriation.

- De-dollarization: BRICS nations are accelerating trade in non-dollar currencies and acquiring gold at record pace, outpacing Western central banks.

Tether’s CEO, Paolo Ardoino, framed the move as a cost-efficiency tactic, noting that vaulting their own gold slashes long-term custody fees. But make no mistake: this is also about control—and a hedging of existential risk.

As the fiat currency model stumbles under its own weight, private entities are increasingly turning to gold to escape the trap.

🏦 The Return of Private Gold Vaulting

For decades, physical gold storage was dominated by central banks, large financial institutions, and the ultra-wealthy. But in recent years, we’ve seen a resurgence of private vaulting, as individuals and companies seek refuge from:

- Bank Bail-ins

- Currency Confiscation

- Capital Controls

- Central Bank Digital Currencies (CBDCs)

Tether is now part of that trend, but on a much grander scale. This isn’t a few hundred gold coins buried in a backyard. This is state-scale metal storage, built by a company often criticized for lack of transparency, now signaling a major distrust in the financial system by quietly stacking real money.

Switzerland—long known for neutrality and discretion—remains a favored jurisdiction for such vaults, and for good reason. Its legal framework protects private property rights, even against foreign government pressure. However, the scale of this operation raises a provocative question: What happens when private vaulting rivals that of central banks?

⚖️ Regulation Is Coming—for Better or Worse

Tether’s bold move comes as stablecoin regulations in the U.S. and EU take shape. Both jurisdictions are exploring (or imposing) rules that would require stablecoin issuers to back tokens only with cash or short-term government debt. Not gold. Not crypto. Not private loans.

This puts Tether in a bind. While their USDT reserves are still predominantly short-term Treasuries, the gold component could face regulatory exclusion—or forced unwinding.

However, this risk may be intentional. Tether’s long been known for dancing at the edges of the regulatory perimeter. By securing hard assets outside of traditional financial rails, they may be preparing for a world in which:

- Banks limit withdrawals.

- Governments freeze crypto wallets.

- Capital flight laws restrict offshore movement.

In that environment, a private gold vault—especially one far from Wall Street’s reach—isn’t just smart. It’s essential.

🌍 Macro Implications: A New Kind of Monetary War

What makes this moment unique isn’t just the amount of gold Tether owns. It’s the paradigm shift it represents.

1. Private Institutions as Sovereign Actors

Tether’s actions mimic those of a central bank: managing reserves, issuing currency (USDT and XAUT), and securing physical gold in a sovereign-adjacent jurisdiction. This blurs the line between nation-state and corporation.

It also signals a future where private monetary systems coexist—or clash—with national ones.

2. Gold as the Base Layer of Trust

This move reinforces gold’s enduring role as the ultimate collateral. Unlike treasuries or cash, gold isn’t someone else’s liability. In an age of financial engineering and balance sheet opacity, this matters more than ever.

Even the crypto world—born to disrupt central banks—is now turning to gold to ensure trust.

3. Implications for Individual Investors

If you’re a private investor or saver, Tether’s vault play offers a clear takeaway:

Follow the big money.

When billion-dollar firms vault physical gold in private facilities, it’s not paranoia. It’s strategy.

The question is: Are you doing the same?

🧱 What Gold-Broker.com Offers That Tether Can’t

Tether’s play has sparked curiosity around gold-backed stablecoins. They’re digital, convenient, and claim to be backed by the real thing. But these tokens are not the same as owning allocated, physical gold in your name.

Consider:

| Feature | Gold-Broker.com | Tether’s XAUT |

|---|---|---|

| Legal Ownership | You own specific bars | Tether owns the gold |

| Vault Access | Independent, verifiable | Controlled solely by Tether |

| Jurisdictional Protection | Client-based | Switzerland, corporate-held |

| Counterparty Risk | Minimal | High (Tether is centralized) |

| Redemption | Physical | Redemption not guaranteed |

Tether’s vault reinforces the value of physical gold—but only if you control it.

At Gold-Broker.com, we provide direct ownership of gold and silver, stored in your name, outside the banking system, in high-security vaults in jurisdictions like Switzerland and Singapore. You can inspect it. You can audit it. You can take delivery.

No tokens. No promises. Just real metal.

🔑 Final Thoughts: Sound Money Is Back in Style

In the early 2010s, the phrase “Bitcoin is digital gold” took hold. It made sense—both were scarce, decentralized, and permissionless. But over time, investors have realized something deeper:

In times of extreme risk, nothing replaces the real thing.

Tether’s $8 billion gold stack is not a gimmick. It’s a signal. A beacon. A return to fundamentals.

As governments flirt with debt monetization, programmable currencies, and increasing financial surveillance, private actors are opting out. Quietly. Cautiously. In gold.

And so should you.

🚨 Act Before the Storm

📦 Secure your gold today with full ownership, full privacy, and full access.

Click below to open an account and store gold outside the banking system with Gold-Broker.com.

👉 Get Started with Secure Gold Ownership

The Gold-Broker.com Team