The BRICS Gold Standard: Why Gold Is Already the BRICS Common Currency

By Gold-Broker.com

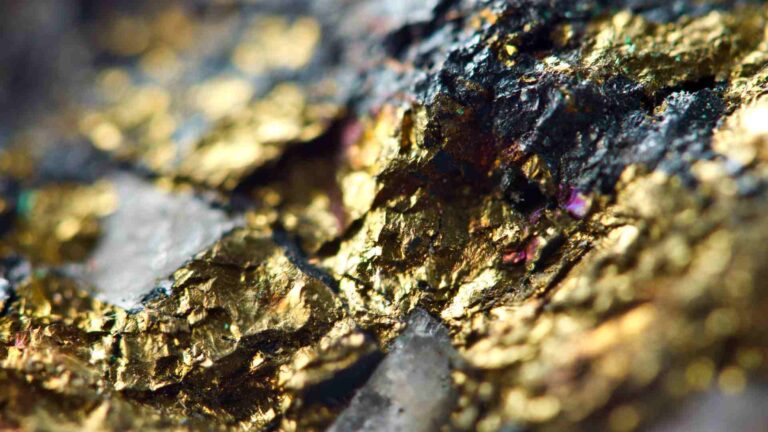

While mainstream headlines speculate breathlessly about the creation of a new BRICS currency or a return to a gold standard, the reality is more nuanced — and more important. Gold doesn’t need to be declared a currency. It already is one. Quietly, persistently, and without fanfare, the BRICS nations — Brazil, Russia, India, China, and South Africa — have been building the foundation of a multipolar monetary system, and that foundation is built on gold.

This transformation is not merely theoretical. It’s evident in trade behavior, central bank activity, and reserve strategy — all pointing to one conclusion: gold is the real reserve currency of the BRICS bloc.

A Practical Gold Standard — Without the Announcements

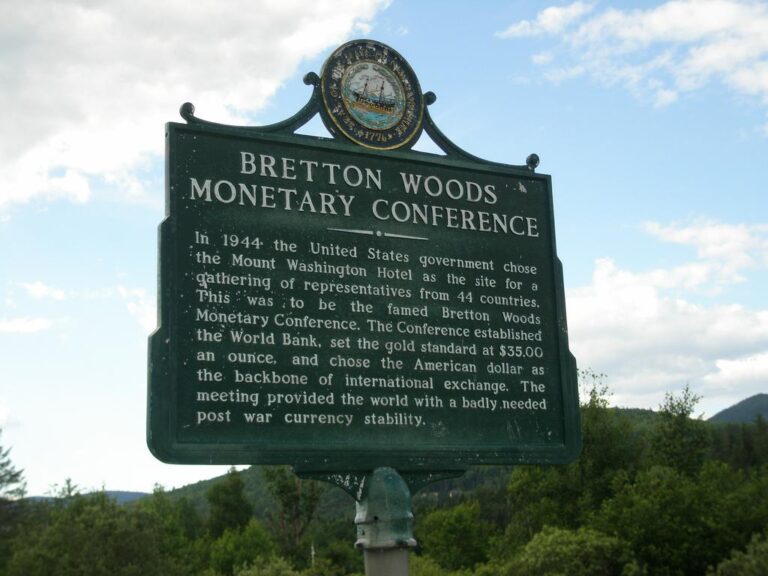

Calls for a “new BRICS currency” — possibly backed by gold — are popular among financial analysts and contrarians, often pitched as a direct challenge to the U.S. dollar’s supremacy. But those hoping for a formal Bretton-Woods-style announcement are likely to be disappointed. The BRICS don’t need to make headlines. They are already making history.

Each BRICS country has different economic strengths and geopolitical pressures, but they share one thing in common: a desire to reduce dependence on the U.S. dollar and insulate themselves from the West’s financial sanctions architecture. In that pursuit, gold plays a central role.

Take the example of trade settlement. When Russia runs a trade surplus with China, it accumulates yuan. When China runs a surplus with Brazil, it accumulates reais. These local currencies have limited utility outside the bilateral relationship, and there are no deep, liquid bond markets in these currencies where central banks can park large reserves safely.

Converting excess reserves into U.S. dollars — still the most liquid asset pool in the world — is an option. But doing so exposes those reserves to seizure or sanctions, as Russia experienced firsthand in 2022 when over $300 billion of its foreign reserves were frozen by Western governments.

The alternative? Gold.

Gold as the BRICS’ Silent Settlement Layer

In practice, BRICS central banks are using gold as a settlement layer. It’s the common denominator that every member accepts. Unlike the U.S. dollar or euro, gold cannot be weaponized by Washington or Brussels. It can be held outside the Western financial system, in secure vaults controlled by BRICS governments or even in neutral jurisdictions.

Gold is also universally accepted, apolitical, and — when held in physical form — free from counterparty risk.

As a result, it’s becoming the reserve asset of choice, and this is borne out by hard data.

Central Bank Gold Reserves: BRICS Are All In

Since the 2008 Global Financial Crisis, BRICS central banks have been quietly stockpiling gold. The motive is clear: reduce vulnerability to dollar-based financial sanctions and diversify reserve holdings away from debt-based fiat currencies.

Let’s examine the official numbers:

- Russia increased its gold reserves from 531 metric tonnes in 2009 to 2,333 mt as of 2024 — a 339% increase. Russia is now one of the world’s largest official holders of gold.

- China reported an increase from 600 mt in 2009 to 2,293 mt — but analysts widely believe the real number could be closer to 4,000–6,000 mt when accounting for undisclosed purchases and off-books holdings in sovereign wealth vehicles.

- India went from 358 mt to 880 mt over the same period, while Indian households — known for their cultural affinity toward gold — are estimated to hold over 5,000 mt in private hands.

- South Africa, despite being a major gold producer, has smaller reserves (125 mt), but its mining capacity and infrastructure make it a strategic player in global gold dynamics.

- Brazil has modest reserves (129 mt), but the recent political and economic alignment with fellow BRICS members signals a potential pivot toward greater accumulation.

Moreover, Iran, a close BRICS partner and likely future member, is known to hold significant undisclosed reserves, acquired in part through oil-for-gold barter trades circumventing dollar-based systems.

De-Dollarization Is Not a Slogan — It’s a Strategy

The term “de-dollarization” is often dismissed in Western circles as hyperbole. But for the BRICS, it is a matter of strategic necessity.

Following the 2022 sanctions on Russia’s foreign exchange reserves and the removal of several Russian banks from SWIFT, the lesson was clear: fiat reserves held in adversarial jurisdictions are not safe. The message was not lost on China, which faces similar risks over Taiwan, or Iran, which has long been under sanctions.

In response, BRICS nations are expanding bilateral trade in local currencies, creating new payment infrastructure (like the Russian SPFS or China’s CIPS), and most importantly, backing reserve diversification with gold.

This approach isn’t just defensive — it’s proactive. Gold allows the BRICS to trade, settle, and store value without relying on the dollar, without needing a new fiat-based BRICS currency, and without placing their trust in Western institutions.

No Need for a “Gold-Backed” BRICS Currency

There has been speculation about a formal BRICS currency backed by gold. But this may be unnecessary. In fact, a new fiat currency could add layers of complexity, sovereignty concerns, and governance hurdles among members who are already wary of supranational monetary control (as the Eurozone has learned).

Instead, gold serves as a decentralized, neutral anchor — a silent standard underpinning reserve policy and trade relationships.

In effect, BRICS already have a “gold-backed” system — just not in the way goldbugs often imagine. There’s no central bank issuing gold notes. Instead, gold itself is the currency.

This approach allows for flexibility, trust, and insulation from geopolitical interference.

Why Western Investors Should Pay Attention

Western investors should not dismiss these developments as irrelevant. The gradual shift toward gold by the BRICS has global implications:

- Persistent Central Bank Demand: Central banks have been net buyers of gold for over a decade, with 2022 and 2023 seeing record purchases. Much of this demand has come from emerging markets, particularly BRICS and their allies.

- Upward Price Pressure: As demand for physical gold increases among central banks, sovereign wealth funds, and even retail investors in BRICS countries, the long-term outlook for gold prices remains bullish.

- Currency System Stress: The BRICS’ retreat from the dollar signals broader mistrust in fiat currency systems, especially amid rising debt levels, declining real yields, and chronic inflation across Western economies.

- Portfolio Insurance: As gold reasserts itself globally as a reserve asset, investors should consider increasing their allocation to physical gold as insurance against geopolitical risk, monetary debasement, and financial repression.

The Quiet Revolution

The idea of a single BRICS currency dominating the world stage may be premature — and perhaps misguided. But the reality of a decentralized, gold-based system emerging under the surface is both more plausible and more powerful.

Without public declarations or formal monetary unions, the BRICS are converging on gold as their shared reserve language. In an era of fractured geopolitics and broken trust, physical gold offers the one thing no fiat currency can: independence.

Gold isn’t just a hedge. For the BRICS, it’s a strategy.

And for investors worldwide, it’s a wake-up call.

Protect your wealth with physical gold.

At Gold-Broker.com, we enable private individuals and institutions to purchase, store, and sell physical gold outside of the banking system, in fully allocated and segregated storage. No paper promises. No third-party risk.

Visit Gold-Broker.com to learn more about how to own real gold, in your name, in secure global vaults.