“The Red Button Option: Could Gold Be Revalued to Save the U.S. Dollar?”

🟡 Gold-Broker.com | July 15, 2025

Secure Your Free Gold Guide 2025!

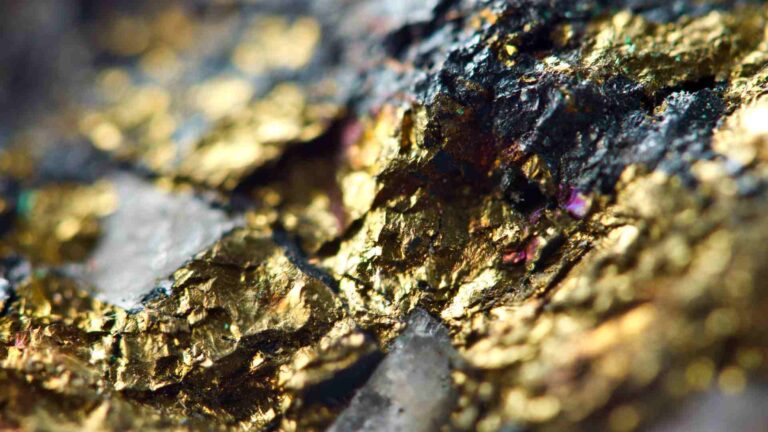

In recent weeks, a topic once relegated to the corners of monetary theory forums and goldbug circles has exploded into the mainstream: gold revaluation.

What was once whispered speculation has now emerged as a serious policy consideration—some even say a potential “Plan B” for the United States as it faces a historic fiscal reckoning. And if the rumors swirling around a possible Trump re-election strategy are to be believed, a dramatic revaluation of the U.S. gold reserves may be closer than anyone imagined.

Let’s break down what this “red button option” really means, why it’s being discussed at the highest levels, and what it could mean for gold investors globally.

🚨 The Setup: U.S. Debt Has Entered the Event Horizon

In the post-COVID era, the U.S. government’s spending spree has gone into overdrive. Washington now carries more than $35 trillion in federal debt, or approximately 120% of GDP. Annual interest payments are set to eclipse $1.5 trillion within a few short years—even assuming that rates don’t rise any further.

Historically, when nations take on excessive debt, they are forced into one of three painful options:

- Austerity – politically impossible.

- Default – economically and globally destabilizing.

- Monetary Debasement – the path of least resistance.

In that third camp lies a stealthier, politically convenient mechanism: gold revaluation.

🔄 What Is Gold Revaluation?

Let’s be clear: this is not about gold going up in the open market due to supply-demand dynamics.

Gold revaluation refers to a government or central bank unilaterally resetting the official price of gold held on its balance sheet, thereby creating new balance sheet value (equity) that can be leveraged for debt management or liquidity creation.

The U.S. currently holds 261.5 million ounces of gold, officially priced at a laughable $42.22 per ounce—a price set in 1973. At today’s market price (~$2,450/oz), that gold is already worth over $640 billion, but officially, it’s valued at less than $11 billion on Treasury books.

Now imagine if the U.S. Treasury revalued its gold to, say, $10,000/oz—a number being floated by several economists and insiders. That would increase the on-paper value of U.S. gold reserves to over $2.6 trillion—equivalent to a full year of tax revenue.

That’s the red button: an instant, politically frictionless method of monetizing debt without raising taxes or issuing more bonds.

🏛️ Historical Precedents: Roosevelt Did It First

This wouldn’t be the first time a U.S. president used gold revaluation to escape a crisis.

In 1933, amidst the Great Depression, FDR confiscated private gold and revalued the official price from $20.67 to $35 per ounce—a 69% increase. That move dramatically boosted the Federal Reserve’s balance sheet and allowed it to expand credit into the struggling economy.

The dollar devalued. Inflation rose. And asset prices (including gold) surged.

The modern playbook isn’t much different. The difference? The stakes are far higher.

🧠 Why Is This Gaining Traction Now?

Two main forces are converging to bring gold revaluation from the fringe to the fore:

1. De-Dollarization is Accelerating

Foreign central banks are aggressively shedding U.S. Treasuries and ramping up gold purchases. The People’s Bank of China has bought gold for 20+ consecutive months. Russia, Turkey, India, and Gulf States are also diversifying out of the dollar.

Even the Bank for International Settlements (BIS) reclassified gold as a Tier-1 asset under Basel III—a significant boost in the monetary status of gold.

As the petrodollar system erodes and alternative settlement systems emerge (e.g., BRICS gold-backed trade mechanisms), gold is increasingly being viewed not just as a hedge—but as the foundation for a new monetary era.

2. U.S. Sovereign Creditworthiness is Deteriorating

The U.S. is running trillion-dollar annual deficits—at full employment. When the next recession hits, deficits will explode, and so will the cost of debt service. Foreign appetite for Treasuries is already waning, forcing the Fed to step in as the buyer of last resort.

A gold revaluation could give the Treasury a balance sheet windfall and buy time before a full-scale debt spiral sets in.

🧨 The Trump Card: Could Revaluation Be a 2025 Priority?

In a provocative recent essay, Matthew Piepenburg argues that if Trump wins in November, his Treasury Secretary (rumored to be John Paulson or Daniel Bessent) could recommend revaluing gold as an emergency monetary maneuver.

It would be framed not as a default or devaluation, but as a restoration of monetary soundness—perhaps even linked to a partial gold standard or “digital gold dollar.”

Sound far-fetched? Not entirely.

- Paulson made his fortune shorting subprime debt and is known as a gold bull.

- Bessent (ex-Fortress) has repeatedly written about structural fiat instability.

- Trump has publicly praised “a strong dollar backed by something real.”

In an environment where the Fed’s tools are exhausted and fiscal policy is politically gridlocked, gold revaluation could emerge as the “nuclear option”—dramatic, populist, and deceptively simple.

📉 Risks and Rewards: What Could This Mean for Markets?

Let’s examine the possible consequences of a U.S. gold revaluation at $10,000/oz or even $20,000/oz.

For Gold:

- Prices would skyrocket overnight. Any revaluation would likely cause physical demand to explode, and mining stocks would see windfall profits.

- GLD and other ETFs might experience significant tracking errors if markets bifurcate between official and spot pricing.

For the Dollar:

- Short-term rally possible (confidence boost), followed by long-term erosion.

- Foreign holders of Treasuries would reassess dollar trustworthiness, likely accelerating de-dollarization.

For Inflation:

- Revaluation is inherently inflationary. Money supply would expand without a matching productivity increase.

- Commodity prices could spike in sympathy with gold.

For Global Monetary Order:

- This could mark the beginning of a post-dollar reserve system, with gold at its center.

- Nations with large gold reserves (Russia, China, Germany) would gain power; gold-poor nations would face currency instability.

📊 Investment Implications: A Strategic Inflection Point

Gold investors have long argued that “one day” the monetary system would return to gold. That day may be much closer than the market realizes.

If a revaluation occurs, it will not be announced years in advance. It will come suddenly, on a Sunday, like Nixon’s 1971 gold window closure. The window for strategic positioning is narrow—and closing.

What you should consider:

- Hold physical gold, outside the banking system—paper proxies may become volatile or unreliable in such a shift.

- Avoid storing wealth solely in fiat assets—revaluation would rapidly erode purchasing power.

- Diversify geographically—a multi-jurisdictional strategy protects against capital controls or forced conversions.

🧭 Conclusion: Revaluation Is No Longer a Conspiracy Theory

For years, gold revaluation was the domain of “hard money theorists” and internet forums. Today, it’s being discussed by ex-central bankers, hedge fund managers, and presidential candidates.

We’re not predicting the exact date or price—but the trajectory is clear: Gold is re-entering the monetary system.

Whether by choice or necessity, the age of fiat hegemony is ending—and gold is ready to reclaim its throne.

The “red button” is real. Whether or not it gets pushed may define the next chapter of financial history.

Stay informed. Stay protected. Stay golden. Free Gold Guide 2025!

Gold-Broker.com Team