From Gold to Fiat: The Monetary History of Gold and Its Relevance in 2025

For millennia, gold has been at the heart of human economies, serving not just as a store of value but as the very definition of money. In 2025, as we navigate a complex financial landscape marked by inflation concerns and digital currencies, understanding gold’s historical role offers valuable insights into our current monetary system.

The Origins of Gold as Money

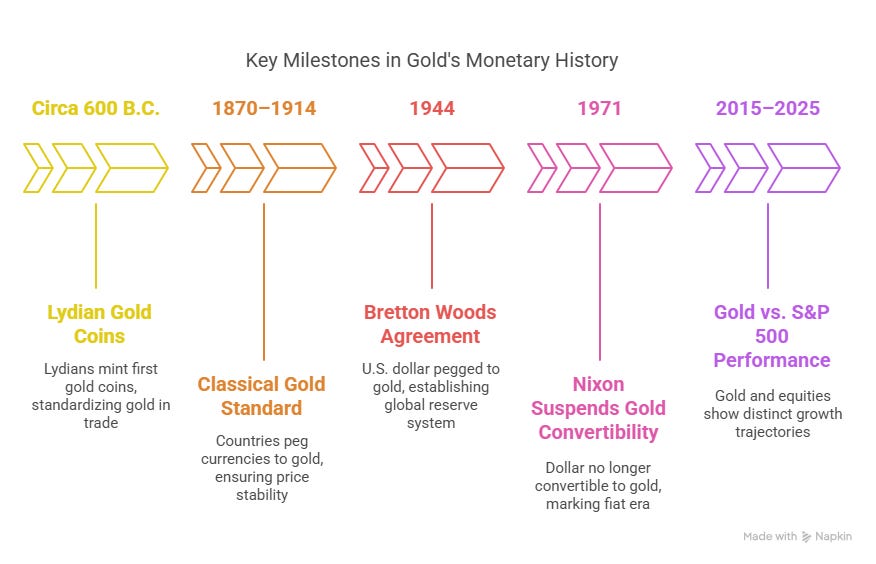

Gold’s journey as a medium of exchange dates back thousands of years. Its unique properties—scarcity, durability, divisibility, and intrinsic value—made it a preferred choice for early civilizations. Circa 600 B.C.: The Lydians, in what is now Turkey, minted the first gold coins, standardizing its use in trade.

Gold’s journey as a medium of exchange dates back thousands of years. Its unique properties—scarcity, durability, divisibility, and intrinsic value—made it a preferred choice for early civilizations.

- Circa 600 B.C.: The Lydians, in what is now Turkey, minted the first gold coins, standardizing its use in trade.

- Ancient Civilizations: From Egypt to Rome, gold was synonymous with wealth and power, underpinning economies and facilitating trade.

The Classical Gold Standard (1870–1914)

The late 19th century saw the establishment of the Classical Gold Standard, where countries pegged their currencies to a specific amount of gold.

- Monetary Stability: This system provided long-term price stability and facilitated international trade.

- Limitations: However, it restricted monetary policy flexibility, making it challenging to respond to economic shocks.

The Bretton Woods System (1944–1971)

Post-World War II, the Bretton Woods Agreement aimed to stabilize global economies.

- U.S. Dollar Pegged to Gold: The U.S. dollar was convertible to gold at $35 per ounce.

- Global Currencies Pegged to the Dollar: Other currencies were pegged to the U.S. dollar, establishing it as the world’s reserve currency.

The End of the Gold Standard (1971)

Economic pressures led President Richard Nixon to suspend the dollar’s convertibility into gold in 1971.

- Transition to Fiat Currency: Currencies were no longer backed by physical commodities but by government decree.

- Monetary Policy Autonomy: Central banks gained greater control over money supply and interest rates.

Gold in the Fiat Era (1971–2025)

Even without formal backing, gold has remained a significant asset.

- Inflation Hedge: Investors turn to gold during inflationary periods.

- Safe Haven: During geopolitical tensions and financial crises, gold often retains value.

- Central Bank Reserves: Many central banks continue to hold substantial gold reserves.

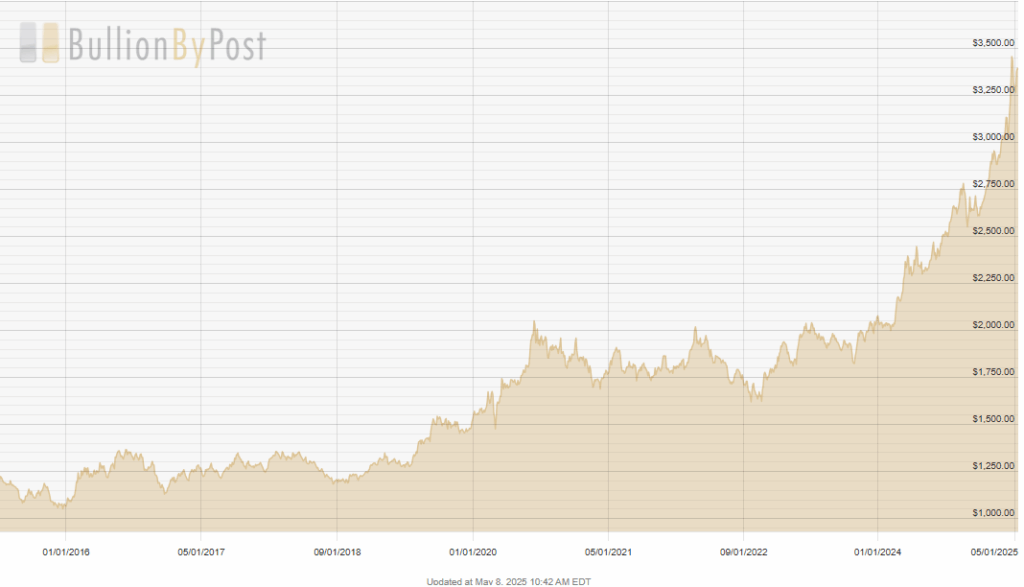

Visualizing Gold and S&P 500 Performance (2015–2025)

To understand gold’s performance relative to equities, let’s examine their trajectories over the past decade.

Gold Price Chart (2015–2025)

Source: BullionByPost

S&P 500 Index Chart (2015–2025)

Source: Macrotrends

Insights from the Charts

- Gold: Over the past decade, gold prices have experienced significant growth, reflecting its role as a hedge against economic uncertainty.

- S&P 500: The index has shown robust performance, indicative of economic expansion and corporate profitability.

Navigating the Monetary Landscape in 2025

In today’s complex financial environment:

- Digital Currencies: The rise of cryptocurrencies and central bank digital currencies (CBDCs) introduces new dynamics.

- Inflation Concerns: Persistent inflation prompts investors to seek assets that preserve purchasing power.

- Diversification: A balanced portfolio may include both equities and commodities like gold to mitigate risks.

Conclusion

Gold’s enduring legacy as a monetary asset underscores its relevance even in a modern fiat-based system. As we advance into an era of digital finance and evolving economic challenges, understanding the historical context of gold can inform more resilient investment strategies.