📈 Gold-Broker.com Weekly Insight | May 21, 2025

🟡 GOLD AT RECORD HIGHS: WHAT THE ECB IS SAYING

Dear Investors,

Gold has hit all-time highs this year — a surge that hasn’t gone unnoticed. In its latest Financial Stability Review (May 2025), the European Central Bank (ECB) issued a focused analysis on the implications of gold’s price trajectory, underscoring what seasoned investors have long understood: gold isn’t just a commodity; it’s a barometer of risk.

🧐 What’s the ECB Saying?

According to the ECB’s report, the rally in gold prices reflects rising investor concerns around:

- Geopolitical uncertainty

- Persistent inflation pressures

- Financial system vulnerabilities

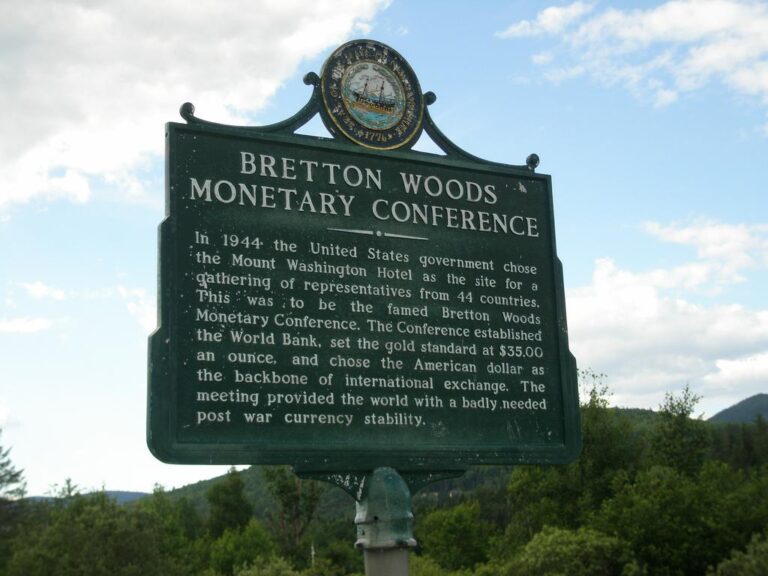

- Eroding confidence in fiat currencies

Gold’s historical role as a safe haven asset is being reaffirmed in real-time. The ECB’s analysis suggests that the current surge is not purely speculative — it’s grounded in broader structural anxieties about the global economy and financial markets.

🔍 What It Means for You

At Gold-Broker.com, we’ve consistently emphasized gold’s role as a hedge against volatility. The ECB’s rare and pointed commentary on gold confirms the strategic thinking behind physical precious metals ownership.

If central banks are closely watching gold, shouldn’t you be?

📊 Market Update (As of May 21, 2025)

- Gold : $3,308/oz 🔼

- Silver: $31.05/oz

- Bitcoin: $109,139 🔼

- S&P 500 Volatility Index (VIX): Elevated

💡 Strategic Takeaway

As gold continues its upward climb, institutional recognition of its risk-reflecting power reinforces what long-term holders already understand: gold is not just a store of value — it’s a strategic asset in turbulent times.

Stay informed. Stay protected. Stay golden.

– The Gold-Broker.com Team

📩 Not yet diversified into physical gold? Open Your Gold Investment Account Today →