🟡 Bond Market Breakdown: The Big Beautiful Signal for Gold

Gold-Broker.com | July 2025 Newsletter

As the U.S. Congress passes the most aggressive fiscal stimulus package in decades—dubbed the “Big Beautiful Bill”—the warning signs from the bond market are becoming too loud to ignore.

It’s not just about more debt. It’s about trust. About solvency. About what happens when the global safe-haven asset, the U.S. Treasury, starts flashing red.

And in the middle of this fiscal storm, one asset is quietly, consistently asserting itself: gold.

Let’s examine what’s really going on, what the data tells us, and why owning physical gold today is no longer just a hedge—it’s a necessity.

🏛️ The Big Beautiful Bill: An Economic Gamble

In late June, Congress passed a $3.3 trillion fiscal stimulus and infrastructure package informally referred to as the “Big Beautiful Bill”—a keystone of Donald Trump’s second-term economic agenda.

It includes:

- $1.1 trillion in infrastructure spending

- $950 billion in tax rebates and family credits

- $700 billion in new industrial subsidies

- Expanded military and border security funding

Supporters call it essential investment; critics call it reckless debt expansion. Either way, it’s now law—and the timing couldn’t be worse.

🧮 Deficits and Debt: The Compounding Crisis

Even before the new legislation, the U.S. was on track for a $2.1 trillion deficit in FY 2025.

Now, with the Big Beautiful Bill added on, that number will likely exceed $3.5 trillion, pushing the U.S. national debt beyond $39 trillion by mid-2026.

And it’s not just the debt—it’s the cost of the debt that’s spiraling:

- Interest on debt (FY 2025): $1.27 trillion

- Projected interest by FY 2030: $2.4 trillion (per CBO projections)

- Debt-to-GDP: Expected to reach 131% by 2026

This is uncharted territory.

📉 The Bond Market Says “No Thanks”

For decades, the U.S. Treasury market has been the bedrock of global finance—a reliable, liquid, safe-haven instrument backed by the full faith and credit of the U.S. government.

That foundation is now cracking.

Recent warning signs:

- June 30-Year Treasury auction: Weakest bid-to-cover ratio in over 5 years

- 20-Year bond yield: Surged to 5.12% (a 14-year high)

- 10-Year yield: Rising toward 4.85%, defying Fed rate expectations

- Term premium: Rising fast—signaling investor anxiety over long-term inflation and credit risk

- Foreign participation: Declining in recent auctions, especially from China and Japan

What does this mean?

Investors no longer trust that long-term U.S. debt is a safe investment. They are demanding higher yields—or stepping away altogether.

🏦 Fiscal Dominance Is No Longer a Theory

When a government’s borrowing needs become so large that monetary policy must be tailored around financing debt—that’s fiscal dominance.

This concept, long debated in economic circles, is now manifesting in real time:

- The Fed may soon have to suppress yields through renewed QE or other balance sheet manipulation—not to stimulate growth, but to keep the government funded.

- That means inflation control becomes a secondary priority—even if CPI begins to rise again.

- The dollar may remain strong relative to other currencies, but its real purchasing power will fall.

This is not just an inflation problem—it’s a confidence crisis.

🧱 The Case for Gold: Stronger Than Ever

Gold has always served three primary functions:

- A hedge against inflation

- A store of value during currency debasement

- A crisis asset when trust in institutions wanes

Today, all three forces are in play simultaneously.

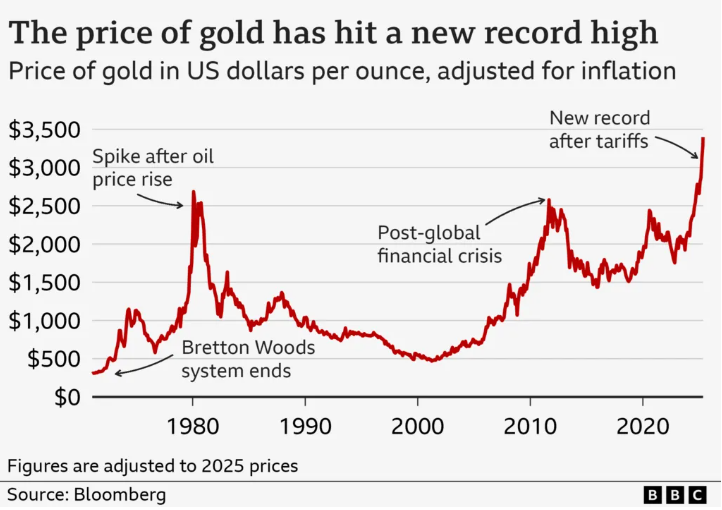

Let’s look at what gold is doing in response:

1. Performance

- Gold is up 18% YTD in USD terms.

- In euro, yen, and yuan terms, it’s made new all-time highs in 2025.

- Silver is following suit, up over 22% YTD as a leveraged monetary metal.

2. Central Bank Buying

According to the World Gold Council:

- Central banks have purchased over 1,250 tonnes of gold in the last 12 months—a 3x increase over the previous decade’s average.

- China, Russia, Turkey, India, and Brazil lead the way.

This isn’t portfolio diversification—it’s a geopolitical rejection of dollar risk.

3. Physical Demand

- Physical premiums are rising globally:

- U.S. Eagle coins: +7–9% over spot

- Singapore kilo bars: +4–5%

- Middle Eastern demand: Up 32% YoY

- Supply chain bottlenecks are increasing delays in delivery

Paper gold and ETFs may respond to financial flows, but the real story is being written in physical metal.

📉 Bonds No Longer Hedge Risk

One of the most important shifts for institutional investors is this:

Long-dated bonds no longer hedge against recession risk or deflation.

Instead, both equities and bonds are falling simultaneously as inflation fears and debt servicing costs dominate the narrative.

This “positive correlation” between stocks and bonds—uncommon historically—means portfolios that once relied on 60/40 allocation models are being blindsided.

Gold, by contrast, remains negatively correlated to broad market stress and currency depreciation.

In other words, gold is doing its job—while bonds are failing theirs.

🪙 Bitcoin: The New Digital Gold?

We’d be remiss not to mention the growing role of Bitcoin in this conversation.

Like gold, Bitcoin:

- Has a fixed supply

- Is not controlled by central banks

- Operates outside traditional finance

Bitcoin is up 42% YTD and is gaining favor as a “millennial gold.”

However, Bitcoin still faces:

- Higher volatility

- Regulatory risk

- Infrastructure and custody uncertainty

That said, we view Bitcoin not as a competitor to gold, but as a complementary asset—especially for younger investors and those seeking asymmetric upside.

🔒 The Importance of Owning Physical Gold

In an era where everything is financialized, digital, and custodial, true ownership matters more than ever.

When banks close, markets freeze, or brokers collapse, paper gold doesn’t help you.

At Gold-Broker.com, our mission is to ensure:

- You own allocated, segregated gold

- Held outside the banking system

- Fully insured and accessible

- With delivery or vault storage options

This isn’t a luxury. In today’s world, it’s a form of financial self-defense.

📊 Final Thoughts: Position for Reality, Not Headlines

Markets are full of noise.

Yes, inflation has cooled slightly in recent months.

Yes, the Fed is signaling rate cuts.

Yes, equity markets are hitting new highs.

But under the surface, the system is groaning:

- Debt is accelerating.

- Bonds are failing to attract buyers.

- The Fed is losing its independence.

- And the most powerful buyers in the world—central banks—are turning to gold.

You don’t need to panic. You need to prepare.

And the first step in any durable wealth preservation strategy is the same today as it was 5,000 years ago:

Own gold.

🛡️ Start Securing Your Wealth Today

At Gold-Broker.com, we offer private investors:

- Direct ownership of physical gold and silver

- Expert guidance on building a gold allocation strategy

🔗 Learn more: Get Your Free Guide Today!

Gold-Broker.com

Real Assets. Real Protection.